Reinsurance broker urges a rethink of the impact from “secondary perils” as extreme weather events drive loss tally

Insured losses from major natural catastrophes in 2021 – excluding Covid-related losses – have so far reached roughly $116 billion, the third largest total since 2011, and about 63% higher than the average loss of $71 billion since 2011.

Like the peak insured natural-catastrophe loss years of 2017 ($143 billion) and 2011 ($120 billion), multiple events are responsible for the large losses, according to Gallagher Re.

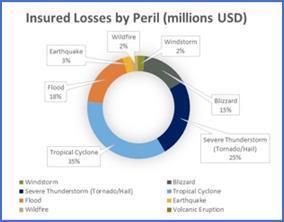

Tropical cyclones caused 35% of the overall loss, and severe thunderstorms 25%. North America was responsible for 68%, and Europe, the Middle East, and Africa 23%. The largest single loss event was Hurricane Ida in August, which cost insurers roughly $37 billion.

Yingzhen Chuang, Gallagher Re’s regional director of International Catastrophe Analytics, said: “With the large loss experience in 2021, catastrophe models are firmly in the market’s headlights. They remain pivotal to enabling conversations around pricing adequacy, secondary perils, climate change, and systemic connectivity of risk, but it has become essential to ensure we understand what models can and cannot contribute to the conversation.”

“By necessity, summarising a complex global picture requires some simplifications. However, it is clear that carefully contextualising global loss experience is essential to an industry founded on managing volatility and uncertainty.”

James Vickers, chairman International, Reinsurance, at Gallagher Re, said: “It was a heavy year for natural catastrophes, despite the absence of a very significant single loss event. Notably, claims originating from secondary perils were substantial. That perhaps calls for an industry-wide redefinition of the phrase, and is certainly a phenomenon that underwriters are paying close attention to.”

No comments yet