ICEYE’s next chapter: broader perils, more satellites, faster insights

An evolving strategy for ICEYE’s insurance solutions arm involves a multi-peril approach

Coalition’s hybrid ‘active’ model for cyber expanding amid soft market – Ram

Coalition’s Shawn Ram says the cyber specialist’s data-driven “active insurance” and reinsurance tools aim to differentiate in a softening market, as the firm expands in Europe with Allianz capacity for France.

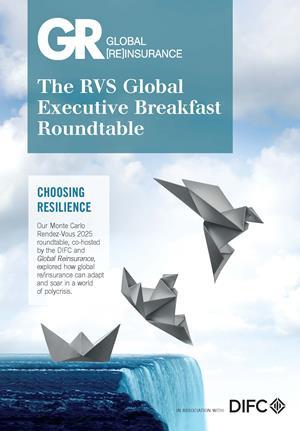

Adapt, evolve, grow – RVS Global Executive Breakfast Roundtable 2025

Senior reinsurance and insurance figures gathered over breakfast at the Hotel Hermitage in Monte Carlo to discuss the re/insurance sector’s ability to embrace resilience, relevance and opportunity in an era where global volatility and change is the only constant

The next phase of AI and digital integration

From AI-driven pricing to interoperability hubs, insurtech professionals at RVS 2025 told GR that the industry has reached a pivot point for meaningful digital transformation, with only 10% of insurers so far claiming to embed AI into workflows.

Kuhn stresses profit discipline as Westfield Specialty trims property and builds in E&S

Westfield Specialty’s Jack Kuhn says the carrier will finish 2025 near $1.8bn in premium after two profitable years, prioritising cycle-proof returns while easing back on property and leaning into E&S casualty, financial lines and cyber.

Bridgehaven not yet ‘scratched the surface’ of growth ambitions – CUO Paul Dilley

Chief underwriting officer explains ‘twofold’ strategy for 2026, which will see the hybrid fronting firm add new UK MGAs to its roster alongside a European expansion

Specialty reinsurance growth opportunities despite market softening – IGI’s Jabsheh

IGI is targeting specialty reinsurance expansion , GR learned at RVS 2025, with CEO Waleed Jabsheh suggesting specialty could become 25% of the firm’s reinsurance book

Blueprint Two delay to boost in-house tech innovation

Firms now have ’the room and scope to invest in their own problems that actually matter to them and not just the market initiative’, says tech company president

Casualty is a pain, not a crisis – Howden Re’s Flandro

Reinsurance broker’s head of industry analysis and strategic advisory, David Flandro says US liability stress is being offset across lines, while property cat sits in a market softening that could eventually find a floor as capital costs stay elevated.

Reinsurers turned a blind eye to climate crisis in Monte Carlo, campaign group warns

Ariel Le Bourdonnec was unimpressed by reinsurers contentment to insulate their financial results from climate risk and prioritising other threats in their briefings at this year’s reinsurance rendezvous

Pro’s Maleary: Orb Specialty bridges gap between capital and MGAs

Pro MGA Global Solutions’ launch of Orb Specialty has been part of the company’s plans since 2016, awaiting the desired scale to launch, CEO Danny Maleary tells GR.

Fac growth and hybrid flexibility key to strategy – Everest’s Izzo

Everest’s Anthony Izzo, explains that the reinsurer’s leaning into property facultative, building hybrid structures, and using technology to strengthen long-term partnerships.

Bruniecki: Long-term relationships anchor MS Re strategy

MS Reinsurance is doubling down on stability and client partnerships as market volatility and geopolitical uncertainty weigh on the reinsurance sector, according to Jorg Bruniecki, chief underwriting officer, global specialty lines, MS Re

Specialty balancing competition with sustainability – Munich Re’s Schwimmer

Munich Re’s Christa Schwimmer says the specialty reinsurance market faces mounting pressures across marine, aviation and cyber, but stresses the importance of discipline, differentiation and long-term client partnerships.

Reinsurance showing ‘greater willingness to be innovative’ – BMS Re’s Dudley

Alongside data usage developing reinsurance delivery, chief broking officer believes ‘a real crossover’ is ‘happening between insurers and reinsurers’

Swiss Re notes nuclear growth, SRCC exposures and geopolitical volatility

At RVS 2025 in Monte Carlo, Swiss Re executives highlighted nuclear energy investment, rising civil unrest exposures and geopolitical volatility as prominent features of the evolving risk landscape.

Aon’s Pennay: ILS maturity opens new growth pathways

Richard Pennay, CEO of Aon Securities, says cat bonds have become a central feature of the reinsurance landscape, with casualty and cyber poised to fuel the next phase of insurance-linked securities (ILS) development.

Pro MGA Global Solutions launches Orb Specialty to link capacity with MGAs

New MGU designed to streamline distribution and strengthen incubation ecosystem

Models present opportunity to plug protection gaps – Verisk

Data from risk models could be used to show reinsurers where to ‘spread their capacity’ – or shine a light on ‘over exposed’ areas that firms should instead pull out of

OneAdvent plans US expansion in 2026 ‘to attract ambitious, bigger MGAs’ – Quayle

Chief executive confirms additional plans around underwriting capabilities and capacity that he hopes to get off the ground next year too

Uncertainty caused by unclear data adding up to 10% on cedents’ premiums

Lack of ‘solid data’ to underpin artificial intelligence tools in the reinsurance industry is ‘akin to building a house on very shaky foundations’, Supercede adds

A market on the move: benchmarking survey

The MEASA region’s re/insurance market shows signs of resilience and untapped potential, according to GR’s RVS Benchmarking Survey for 2025

Lockton Re urges cyber re/insurance to invest for growth by 2030

Reinsurance broker warned at RVS 2025 that growth expectations for cyber re/insurance will only be met if the industry invests in data, modelling and flexible product design, as its new report forecasts the market could more than double by 2030.

Lloyd’s is ‘a highly compelling platform for third party capital’

The marketplace’s London Bridge 2 model ‘complements’ reinsurance’s alternative capital tools, such as catastrophe bonds, say market leaders

Cyber reinsurance faces structural test at inflection point – Ariel Re’s Carr

Dan Carr, head of cyber at Ariel Re, tells GR at RVS 2025 that the cyber market must adapt its structures and products to achieve sustainable global growth, with systemic exposures reshaping the risk landscape.

‘Nowhere near’ drawing line under ‘legal system abuse’ – AM Best

US-based litigation funding is impacting social inflation – a key concern for casualty reinsurers, says credit rating agency

Hannover Re to launch non-proportional catastrophe sidecar

Executive board member explains that new underwriting agency fulfils “missing” element of the reinsurer’s current ILS portfolio

Trade credit is evolving – Allianz Trade Americas’ Murrow

Rising exposures are outpacing premium growth, while trade credit is still seen as a discretionary spend, rather than an enabler for growth, president and CEO of Allianz Trade Americas Sarah Murrow tells GR

Navigating volatility: Charting a resilient path in uncertain times

Successful players are those willing to invest in automation, streamline processes, and break down organizational silos, writes MS Re’s CUO of global specialty lines Joerg Bruniecki

Rethinking hurricane response using SAR satellite data

How satellite radar is revolutionising hurricane insurance response, by ICEYE’s Rupert Bidwell

Reinsurance will stand up to Irma – JLT Re

While comparisons to Hurricane Andrew were made, JLT Re executives believe the industry will react better this time

Guy Carpenter's James Nash

Guy Carpenter’s James Nash discusses his firm’s reorganisation, the uptick in reinsurance purchasing and why insurers are playing catch-up

AIR estimates top industry insured losses of $40bn for US from Irma

AIR makes early predictions at Monte Carlo RVS 2017

UK regulators could prove a blocker for London’s ILS ambitions

Guy Carpenter’s Des Potter speaks to Global Reinsurance during Monte Carlo RVS 2017 season

Hamilton Re's Kathleen Reardon

The Hamilton boss thinks insurance needs to catch up to stay relevant

Cat bond concentration in Florida at risk with Irma looming

Experts outline the potential impact at RVS 2017

Reinsurers ‘living off the past’ with reserve development, says AM Best

AM Best sheds light on underlying negative trends in reinsurance at RVS 2017

(Re)insurers should intensify R&D to stay relevant, says Stephan Ruoff

For Monte Carlo RVS 2017, we ask Tokio Millennium Re chief executive Stephan Ruoff what is on the horizon for the (re)insurance industry in 2017 and beyond

Willis Re’s Andrew Newman, Mark Hvidsten and Andrew Johnston

Change is inevitable – and brokers are thought to be at the sharp end of it. But is this perception accurate? We ask three senior executives at Willis Re about the need to innovate and the challenges posed by insurtech

Q&A: Thomas Lillelund, on being Aspen Re chief executive

The new Aspen Re CEO speaks with Global Reinsurance about making a big splash in a crowded marketplace

Monte Carlo Archive 2016

At the forefront of disruption

Ahead of this year´s RVS, Willis Re gobal chief executive John Cavanagh talked to Global Reinsurance about the WTW merger, disruption and the need to be proactive

ILS: Opportunities for collaboration

Munich Re hosted its 8th ILS Roundtable at 2016 Monte Carlo RVS

Assumptions about shrinking market, ‘not wholly true’

Hannover Re chief Ulrich Wallin revealed growth plans at Monte Carlo breakfast briefing

GR Monte Carlo Daily - Day 3

Available in hard copy at Monte Carlo RVS, or online, read our daily to stay up to speed with the latest from Monte and insight into some of the industry’s hottest topics

Capital partnerships: the way forward

Axis Re Chief executive Jay Nichols talked to Global Reinsurance during this year´s RVS

AM Best holds its negative outlook for the reinsurance sector

AM Best experts held a briefing at the Monte Carlo RVS

GR Monte Carlo Daily - Day 2

Available in hard copy at Monte Carlo RVS, or online, read our daily to stay up to speed with the latest from Monte and insight into some of the industry’s hottest topics

John Berger: "Our investment model is easing pressure of soft rates"

Third Point Re’s chief executive talked to Global Reinsurance at this year´s RVS

GR Monte Carlo Daily - Day 1

Available in hard copy at Monte Carlo RVS, or online, read our daily to stay up to speed with the latest from Monte and insight into some of the industry’s hottest topics

GR Monte Carlo Special 2016

This special Monte Carlo RVS edition of Global Reinsurance includes: profiles with ex-Lloyd’s chairman Max Taylor and IGI chief executive Wasef Jabsheh; analysis on man-made earthquakes and big data; and interview with group Willis Towers Watson group chief executive John Haley; and our Monte Carlo Top 20 Cedants report