Risks are escalating as the world lurches from one crisis to another, bringing about a fundamental shift in supply and demand, warns broker

The three Cs of climate, conflict and capital are coalescing to create a tipping point for the reinsurance market, with 2022 mid-year renewals seeing rate increases accelerate to their highest levels since 2006.

This is according to Howden’s reinsurance report ahead of the Rendez-Vous de Septembre in Monte Carlo, titled A Tipping Point, which reveals some of the drivers behind the significant shifts taking place in the reinsurance market ahead of year-end renewals.

Having initially stood firm in the face of headwinds that began in 2017, including painful weather losses, a global pandemic and accompanying financial market volatility, persistent catastrophe loss frequency and major macroeconomic and geopolitical realignments this year have exacerbated pressures and, crucially, altered assumptions around yields, capital and loss costs.

Risks are escalating as the world lurches from one crisis to another, bringing about a fundamental shift in supply and demand.

Bradley Maltese, CEO, Howden RE comments: “After years of excess capacity, loss uncertainty and the changing world order have combined to create some of the most challenging market conditions in two decades.

“Pricing and risk appetites are responding accordingly. No two cycles are the same, however, and new capacity could very soon be enticed into the market, given current rating levels and the higher potential returns on offer.

“Capital providers’ price expectations have continued to shift in line with structural changes to the loss environment, meaning that 2023’s reinsurance renewal cycle is likely to see further pricing pressures.

”Loss experience from here will be crucial: whilst pressure will increase if the wind blows this year, it will be more muted off the back of a loss-free second half. Choosing your intermediary carefully is essential in helping cedents secure the best and most cost effective coverage available in the current environment.”

Climate

The property-catastrophe market is currently in the eye of a price, risk and inflation storm, and reduced capital inflows, along with rising ‘secondary’ peril losses, the three-year average of which has nearly doubled since 2013, have strengthened reinsurers’ resolve to meet rising costs of capital.

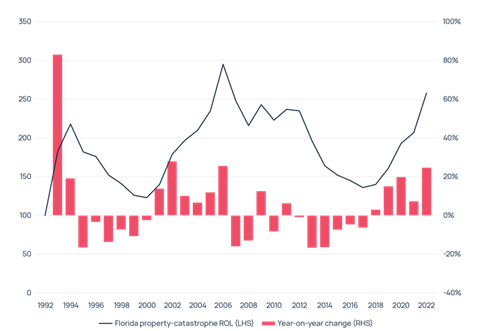

All of these factors are starting to tell, with signs of distress at mid-year renewals. Property-catastrophe pricing for Florida business rose by an average of 25% at 1 June. A cumulative increase of 90% in the last five years has seen Howden’s 1 June ROL index rise to its highest level since 2007.

Figure 1: Howden 1 June Risk-Adjusted Property-Catastrophe Rate-on-Line Index – 1992 to 2022 (Source: NOVA)

Conflict

Whilst Ukraine war claims are likely manageable overall for the (re)insurance sector, the concentration of losses amongst premium-light lines of business will lead to disproportionate pain.

Current industry loss expectations range from $10 billion at the low end to upwards of $20 billion; reported claims (of $2.5 billion to date) have a long way to travel before they get close to these figures.

With unexpected war losses coming fast on the heels of unexpected pandemic losses from COVID-19, reinsurers’ exposure to loss aggregation in such a volatile risk landscape has contributed to the transitioning reinsurance cycle in 2022.

Both events have revealed how perils once regarded as ‘distinct’, eg business interruption, supply chain failures and price shocks, can in fact be connected and strike simultaneously.

Capital

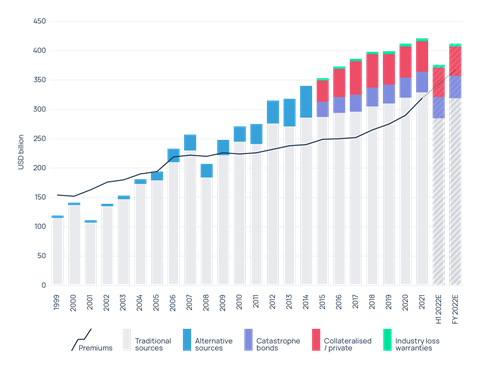

Capital impacts have been significant, as asset markets adjust to the end of the ‘great moderation’. 2022 already represents a local low for dedicated reinsurance capital.

An 11% impairment during the first six months of the year, together with significantly higher premiums, sent the sector’s solvency margin ratio (capital divided by premiums) back to levels last recorded in the depths of the global financial crisis.

Even assuming a recovery in financial markets in the second half, which is far from assured, capital losses are unlikely to recover fully this year.

Any year-on-year decline in reinsurance capital at the end of the December would represent the first full year reversal since 2008, and provide further impetus for market firming.

Figure 2: Sizeable reductions in dedicated reinsurance capital levels for 2022

Elliot Richardson, chair, Howden RE adds: “Unlocking capital in order to find solutions for risks that may soon outgrow the sector’s capital base will be crucial to maintaining relevance and offering clients coverage that meets their rapidly changing needs.

”Clients demand better data, world class analytics, scale and a unique blend of capital markets and risk transfer. In these market conditions, clients need a new approach to broking that is innovative, aggressively entrepreneurial and home to the sector’s strongest talent. In 2023, Howden Tiger will be delivering just that.”

GR Main Edition 2022: Disrupting the Oligopoly

As market practitioners prepare to meet once again in Monte Carlo, the current headwinds are undoubtedly challenging… but they are not insurmountable.

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

Currently

reading

Currently

reading

Reinsurance market reaches ‘a tipping point’ - Howden

- 24

- 25

No comments yet