Hard market momentum continues as hurricane season gears up. Pricing is expected to rise, said the overwhelming majority of respondents to GR’s 2023 renewals survey.

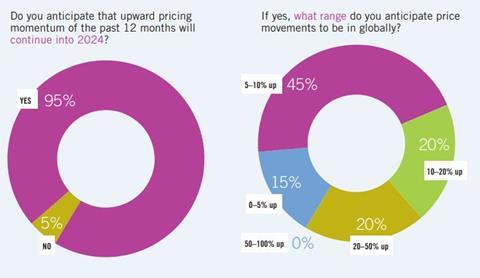

For anybody doubting reinsurance market discipline, a 95% “yes” answer is strong survey confirmation that hard market dynamics continue as the next renewals draw closer. When the same question was asked before the last 1/1, 87% said “yes” – and that turned into a dramatic renewal.

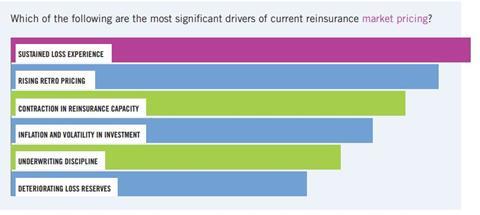

The primary reason remains the sustained loss experience for reinsurers.

This will surprise few in the market, as reinsurers eye a full year of profitable underwriting – their other eye is likely on Florida’s weather forecast.

“Basic loss costs have moved much higher than previously anticipated, along with a higher rate of return needed for capital deployed.”

The degree to which prices will rise at 1/1 is still a matter for crystal ball gazers, it seems. One in five respondents (20%) still expect a 20-50% rate increase.

Some 46% of respondents thought prices might move between 5-10%, another 22% of replies thought a 10-20% rise is in the offing at renewals, while the same number of respondents thought only a 0-5% rise is on the cards.

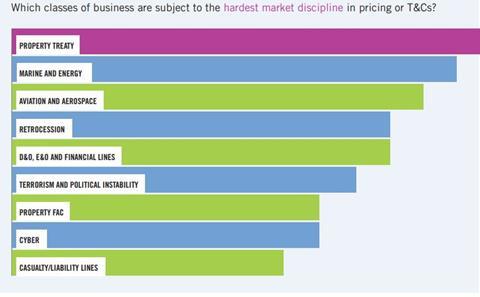

Hard pricing is expected not to be dominated by property but across specialty lines, for instance.

This was reflected in respondents comments highlighting geopolitical risks and macroeconomic concerns as well as in the chart of classes expected to show leading price discipline, such as marine and energy, aviation, terrorism and political risk business.

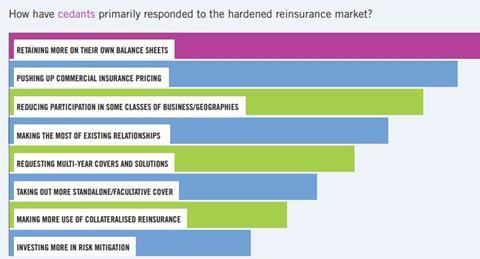

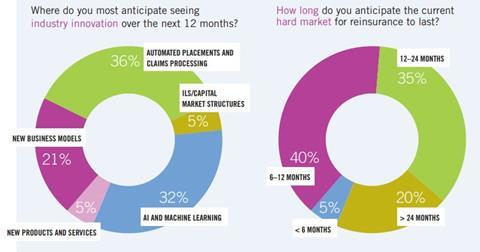

Those who hoped that reinsurers’ rate rally might run out of steam in 2023 will be sorely disappointed. While opinions vary on how long the hard market will last, some 40% thought another six to 12 months, and another 35% suggested the hard market would go on for another 12-24 months – a sobering thought for buyers.

No comments yet