Stability returned to the market at mid-year renewals for specialty reinsurers buyers, but firming rate pressures continue, terms are tight, and capacity at lower attachment points is limited.

Guy Carpenter has issues a “Specialties Market Update” outlining key developments in the global specialties sector in the run-up to the 1 January 2024 renewals.

The reinsurance broker said the previous 1/1 renewals had been one of the most challenging placement periods for specialty buyers in decades.

Since then, “the waters have calmed slightly”, the intermediary said, and a greater sense of stability returned at the mid-year renewals, however, the market remains challenged.

Timed for the Monte Carlo Rendez-Vous de Septembre (RVS), the brief addressed changes in supply and demand across non-marine, marine and energy, aviation and aerospace, and trade credit, bond and political risk sectors, exploring factors for upcoming renewals negotiations.

“In the current environment, preparation is key,” said James Boyce, CEO, global specialties, Guy Carpenter.

“The ability of clients to articulate their portfolio effectively and demonstrate the success of their underwriting strategy will be central to productive negotiations. Furthermore, having access to a broad mix of products and capital pools and being armed with comprehensive market data underpinning a well-defined renewal strategy will be crucial,” Boyce added.

AVIATION & AEROSPACE

- · There has been a growing divergence between the aviation insurance and reinsurance markets, with substantial pricing increases in cat-focused excess of loss (XoL) reinsurance, whereas the direct market is seeing some rate reductions in certain segments.

- · Reinsurance appetite remains strong, and capacity is generally sufficient, with availability even for challenged sub-classes such as hull war and excess AVN-52 exposures.

- · Aviation program changes reflect tighter coverage, with insurers reducing cessions and increasing retentions to mitigate price increases and tougher terms and conditions.

- · Overall, reinsurance capacity should remain relatively stable. However, reinsurers concerned about rating adequacy for proportional capacity could pull back if direct rates reduce further.

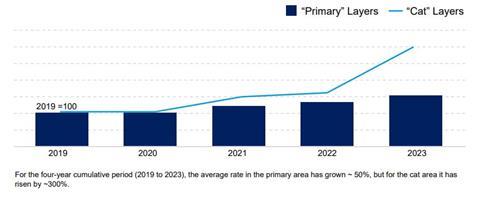

The below chart taken from Guy Carpenter’s analysis shows the estimated average year-on-year rate change for aviation excess of loss reisurance programmes.

“Claims inflation is a continuing concern for (re)insurers, having increased over recent years,” Ian Wrigglesworth, head of aviation and aerospace specialty, said.

“The cost of repairing aircraft is significantly higher, due to a combination of advances in aircraft technology, inflation, fluctuating currency exchange rates, a general shortage of skilled labour and longer supply times.”

Andy Edwards, managing director, aviation and aerospace specialty, said: “Aviation insurers are focused on maximising profitability and are continually looking at how best to balance their portfolios comprising airline, general aviation, and aerospace business. As such, they will continue making adjustments to their business mix through changing appetite for each class of business.”

Wrigglesworth added: “Guy Carpenter has been working with cedents by providing insights into their exposures, and where and how to improve portfolio mix, and identify key pricing influencers. Part of that conversation is about ensuring that reinsurance buyers have a clear underwriting strategy, including firm ‘walk-away’ criteria.”

NON-MARINE

- · There is some excess capacity for non-marine risks at the upper end of programs, but limited availability at the lower levels, particularly for non-modelled or poorly modelled perils.

- · Non-marine retro rates have stabilised after a period of hardening, but capacity is uncertain due to fluctuating investor appetite. However, new capacity has entered the market.

- · Mid-year negotiations have transitioned from being capacity driven to focus more on price, attachment levels and coverage.

- · For many buyers, navigating the widest potential pool of capacity or capital providers will be the optimal retrocession strategy in 2024.

“The non-marine retro market has experienced a period of significant rate hardening in recent years,” said Boyce

“However, greater price stability was witnessed between January 1, 2023 and the mid-year renewals. The mid-year placements also saw movement on minimum rate on line levels and greater reinsurer willingness to deploy capacity at lower rates,” he continued.

“The focus of negotiations in many cases since January 1 has transitioned from one of capacity, to a more pragmatic and considered discussion centred on price, attachment levels and coverage. Many retro providers have made clear their stance around minimum attachment levels that often exclude potential exposure to higher frequency perils and attritional losses,” Boyce said.

Richard Morgan, head of non-marine specialties, added: “The ability of cedents to navigate the widest potential pool of capacity or capital providers will be important when optimising retrocession strategies in 2024.

“Current hard market dynamics, when expected margins look positive, create the right time for buyers to develop extensive relationships across both the traditional and alternative markets in order to create competitive tension not just for the January 1, 2024 negotiations, but through the wider market cycle.”

MARINE & ENERGY

- · The energy market faces continuing challenges from the Russia-Ukraine conflict, contending with a reduced premium level resulting from global sanctions.

- · Marine reinsurers have been consistent in excluding losses on land and limiting cover available for voyages and shipping risks within the conflict zone.

- · Renewals for programs with war, terrorism and political violence exposures are likely to remain challenging.

- · There is likely to be increased demand for renewable products, alongside a continuing need for coverage of legacy fossil fuel assets through the energy transition.

James Summers, deputy CEO of global specialties and global head of marine and energy specialty, said: “With an ongoing military conflict in Europe and the potential for an escalation in geopolitical tensions in other parts of the world, the marine market finds itself in uncharted territory as it assesses the current and future impact on vessel movements.”

Nick Jay, deputy global head of marine and energy specialty, said: “Inflation is still a significant factor for both insurers and reinsurers in the marine and energy markets.

“While insured values are customarily adjusted in line with rising inflation, the cost of repairs and potential time delays are both issues for the market. Inflation is also driving demand for more limit as values are reassessed,” he said.

Summers added: “Guy Carpenter believes that the focus at renewals should be on what the client needs to buy, and negotiations should be transparent, data-led, and appropriate. Data continues to be key to understanding the original risk and finding alignment between insurers and reinsurers.”

TRADE CREDIT, BOND & POLITICAL RISK

- · Trade credit, bond & political risk has remained relatively stable, with no major price increases.

- · Despite a general over-supply of reinsurance capacity, there has been some under-deployment by reinsurers cautious about the underlying risk environment.

- · Inflation has been more of a concern than the RussiaUkraine conflict, due to the impact on costs and exposure growth; this is expected to change as related claims eventually come through.

- · Quote ranges at January 1, 2024 are likely to begin from a narrower base than at 2023, with factors including the performance of individual cedents influencing the spread.

“The prevailing sentiment has been a sense of realism about rate developments, with insurers more focused on favourable conditions and capacity than price, and maintaining long-term, reliable relationships with reinsurers rather than pushing for marginal rate reductions,” said David Edwards, co-head, credit, bond and political risk.

“Despite a general over-supply of reinsurance capacity for credit risks, there has been under-deployment by reinsurers, who typically remain more cautious than insurers about the risk environment,” he continued.

“There will be even greater onus on cedents to provide the maximum possible data with detailed quality information provided early being indispensable for generating the best negotiating position. Mid-year renewals have already demonstrated that there is tangible value in supplying more granular data earlier in the process,” Edwards added.

No comments yet