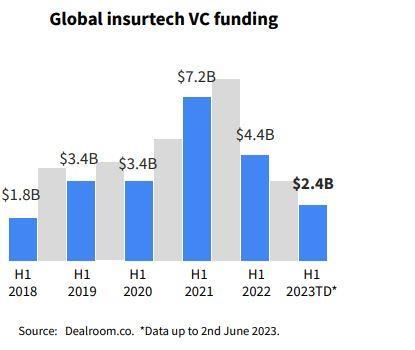

Insurtech funding falls to 2018 levels, but represents a $7trn market, according to a dealroom.co study backed by insurers Generali and Mapfre.

Venture capital investment dipped by 50% in the first half of 2023, compared with the same period last year, according to a new report prepared by dealroom.co, in association with Mapfre, Generali and other firms

Insurtech funding has toughened and is now back to 2018-2019 levels, the study “The State of Global Insurtech 2023” revealed.

Early stage funding and some leading private players show that opportunities still exist for quality startups, the study stressed.

The pullback has been mostly at late stage funding which is down over 60% from peak, while early stage has stabilised at a nearly 30% drop.

Public insurtech valuations have plummeted, although several leading private insurtechs have been able to confirm or even increase their valuation in recent months.

So far no new insurtech unicorns have been minted in 2023, and 13% of all insurtech unicorns lost their unicorn stats.

After reach an all-time peak in 2021, with 26 new unicorn minted, in 2022 new unicorn creation went back to 2020 levels.

Insurance is still a strongly underfunded market, especially in areas such as life insurance, the report emphasised.

Insurtech represents a massive $7trn opportunity, the report estimated.

Financial services, in comparison, represents a less-than-double market size, but received nearly 10 times the funding.

Insurtech has also largely focused on the P&C market, which attracted over 60% of the funding in the latest years.

Life insurance has been particularly underinvested and still awaiting for much needed change, the report found.

Operational efficiency throughout the value chain is increasingly viewed as vital by insurers, the report said, and therefore also as the major focus for the current generation of insurtech startups.

AI is already heavily used by insurance, with variable impact across the value chain, such as in claims automation, according to the report.

Now Gen-AI opens new possibilities, but it is still to be fully understood which processes will be more impacted, the paper said.

“The insurtech industry has been on a roller coaster in the last two years,” said the report’s preface. “Insurtech came firmly into the venture capital scene in 2020-2021 before falling into a disillusionment phase due to the poor performances of a few notable players and a broader market downturn.

“The so-called “death of Insurtech 1.0” has cast the whole insurtech space away from the spotlight, but the insurance industry is still a massive market undergoing major transformations. Insurtech is still a massively underfunded area.

“We believe in its medium and long-term success when moving away from growth-at-all cost and focusing on operational efficiency and profitability, guided by deep insurance expertise and tech,” the report added.

No comments yet