WTW’s latest political risk report shows geopolitical shocks now dominate boardroom concerns, with firms bracing for US trade wars, regulatory expansion, and the erosion of global rules.

Political risk is no longer confined to warzones and weak states, the latest Political Risk Survey and Report from WTW emphasises.

In 2025, it has become a central concern for multinationals operating in some of the world’s most developed economies, the broker warns.

WTW’s biannual political risk survey finds 74% of large global companies rank political risk among their top five business concerns, up from 64% in 2022.

The report, based on a survey of 66 major firms and in-depth interviews with 15 executives, identifies US policy uncertainty as the most prominent threat.

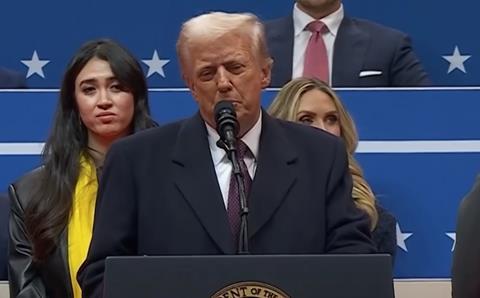

That reflects the early actions of President Donald Trump’s returning US Administration, which has reignited trade wars with China and launched new tariffs against Canada, Mexico and the BRICS nations among others.

The sudden imposition of tariffs globally has unsettled companies across sectors and geographies.

“This kind of uncertainty is difficult for a company of our size,” said a Europe-based electronics executive, speaking with WTW.

“This situation is now shaping our discussions on where we establish our regional footprint going forward.”

Tariff threats have not only been broad-based but also unpredictable in both their timing and scope.

As one executive put it, “Change can happen very, very quickly. We can model risk but we can’t model uncertainty.”

Trump’s so-called reciprocal tariffs have already impacted trillions in global trade, prompting both retaliation and concern from allies and adversaries alike.

Some firms are struggling to keep up, the research reveals.

“We have teams across multiple departments working on this – strategy, manufacturing location analysis, tax, legal – you name it,” said a US food and beverage executive.

“These are big-picture decisions, and they’re taking up a lot of management bandwidth.”

Even sectors that once felt immune to political shocks are now being dragged in.

The report highlights “regulated sector sprawl” as another top risk, where sustainability, data protection and national security are pulling once lightly regulated industries into compliance-heavy regimes.

Executives in telecoms, tech and energy flagged growing anxiety about punitive fines, unclear rules and the sheer pace of regulatory expansion.

“Europe is the region, and antitrust is the risk,” said a US software panelist.

“Do we expose ourselves by launching products in Europe that we might just be forced to shut down again?”

Meanwhile, geopolitical friction is increasingly shutting companies out of strategic markets.

One energy executive noted that China is fast becoming “an increasingly critical source of capital,” while a manufacturing peer warned that “if you take on Chinese investment then that potentially limits your options for expanding your business in other regions.”

That concern cuts both ways, according to WTW.

Executives also fear being locked out of Silicon Valley or Western financial systems due to retaliatory measures.

The result is a strategic squeeze: global firms navigating not just operational complexity but ideological divides.

“Geopolitics is an integral part of our thinking now – it’s fundamental,” said a manufacturing executive.

“Ten years ago we’d just think about finding the lowest bidder, but now every project has a geopolitical angle.”

The trend is evident in loss data, the paper suggests.

In 2023, 18% of firms suffered politically driven losses large enough to require earnings restatements.

Though that number dropped in 2024 and 2025, the damage from conflicts like Ukraine and Gaza, supply chain disruption in the Red Sea, and US-China decoupling continues to mount.

In many cases, insurance recovery is patchy, according to the broking firm.

Just 27% of those with political risk cover managed to claim for recent losses, while others turned to direct negotiation or government lobbying for support.

Mitigation strategies are evolving in response.

The most common is diversification, though some executives are questioning its continued utility in a bifurcating world.

“We can just shift our portfolio around,” said a European energy executive, “but if globalisation breaks down, that won’t be enough.”

Companies are also investing in resilience, local partnerships, and crisis management capabilities.

A “three lines of defence” model—encompassing operations, risk management and audit—is gaining ground, as firms seek to embed geopolitical thinking across all business functions.

Perhaps the most dramatic shift is cultural.

Nearly 90% of firms now say they proactively monitor political risk, up from just over 60% in 2021.

Some have created dedicated geopolitical analysis teams.

“We’re the only company among our peers to have one, even though in my view it’s basically self-destructive not to,” said a European financial executive.

Looking ahead, WTW’s sample of surveyed executives is bracing for more disruption.

Risks gaining attention include cyberattacks on infrastructure, US hostility towards allies, and deeper fragmentation of the global order, the broker warns.

One participant concluded: “The major threat is not China and not Russia, but is what can come from the United States. If we dismantle the international order from the inside, this can impact Europe as nothing before.”

No comments yet