The MEASA region’s re/insurance market shows signs of resilience and untapped potential, according to GR’s RVS Benchmarking Survey for 2025

This year’s Global Reinsurance benchmarking survey, in association with the Dubai International Financial Centre (DIFC) Authority, provides some welcome indications of a reinsurance market in good health.

Most of the nearly 100 responses came from reinsurers, insurers, or brokers.

In keeping with GR’s strength in the wider Middle East, Africa and Southern Asia (MEASA), the Middle East and North Africa represented nearly half of respondents, with Asia, and Sub-Saharan Africa together accounting for another quarter.

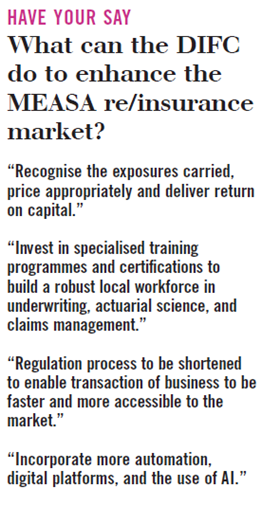

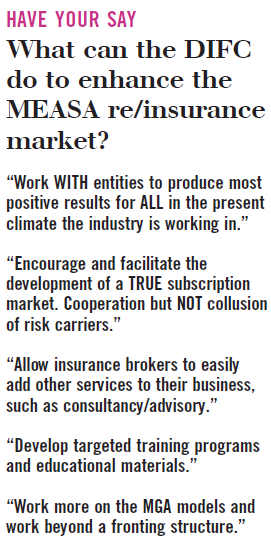

Asked what the DIFC can do to enhance the MEASA re/insurance market, respondents suggested a range of methods to strengthen the MEASA’s market.

A recurring theme was investment in talent development, with call for specialised training programmes, certifications, and education initiatives to build technical expertise in underwriting, actuarial science, and claims management.

Several responses highlighted the importance of regulatory reform, including streamlining licensing, shortening approval processes, and harmonising cross-border frameworks to ease market access.

Some argued for stronger oversight of new entrants and MGAs to safeguard credibility, while others emphasised maintaining professionalism, controlling growth, and protecting market reputation.

Innovation and technology were also central.

Suggestions included developing frameworks for insurance-linked securities and parametric solutions, enhancing automation and AI in underwriting and claims, and creating an electronic trading platform supported by a regional risk data hub.

Respondents also recommended attracting more reinsurers and global capital through sovereign wealth fund partnerships, tax-efficient structures, and incentives for regional hubs.

Overall, participants saw DIFC’s role as connecting global capital with local markets, fostering innovation, and strengthening the region’s resilience.

All about AI

When asked where most industry innovation could be expected in the coming year, there was a standout winner: AI and machine learning.

Given the buzz around AI across the sector, anything else would have been highly surprising.

Automated placements and claims processing presented the second most popular aspect of anticipated innovation.

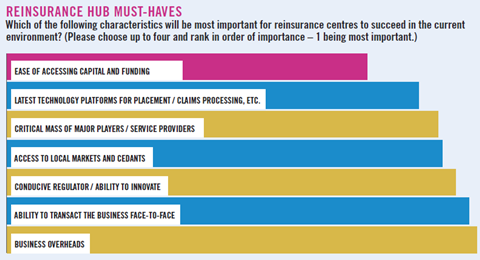

Asked which characteristics would be most important for a reinsurance hub, such as London, Bermuda, Dubai or Singapore, to succeed in the current environment, ease of accessing capital and funding was the top ranked issue.

Other factors vied for attention but without clear front runners, such as doing business face-to-face, access to technology, innovation and a positive regulator, access to local markets, business costs, and a critical mass of major players.

No sudden rate moves

Answers were split over which lines of business would see the biggest price movements at upcoming renewals, led by North American property, but with US casualty and European property business also anticipating some change at 1/1.

Interestingly, the results suggest a market that remains relatively flat, in keeping with the wider talk of gentle softening, but emphasising that discipline is holding, and rate cuts are modest.

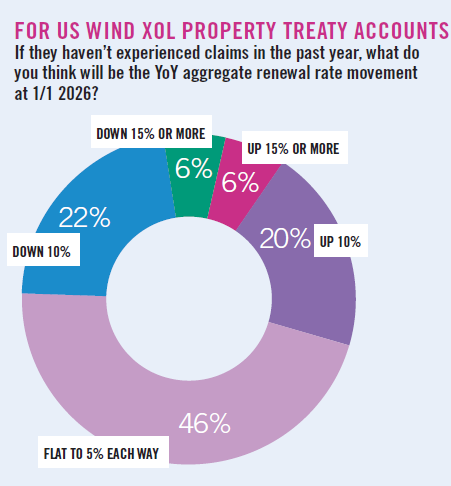

This was true regarding US wind excess-of-loss property accounts.

When asked the year-on-year aggregate renewal rate movement at 1/1, if such treaties stay loss free, the most popular answer was for a flat renewal, down no more than 5%.

Unsurprisingly, wildfire was uppermost in mind among secondary perils, along with floods and severe convective storms, which taken together have contributed the biggest share of insured catastrophe losses in recent years.

To download the full Monte Carlo RVS 2025 annual issue of GR, click here.

No comments yet