All News articles – Page 124

-

News

NewsSeopa and Freedom Brokers team up for van telematics

Freedom Brokers has teamed up with Seopa, the parent company of insurance comparison platforms Quotezone.co.uk and CompareNI.com, to bring its first telematics van insurance offering, initially focusing on light commercial van drivers. Seopa was the first comparison expert in the UK to offer van insurance across its aggregator system and ...

-

News

NewsZurich UK names new CEO as Tulsi Naidu moves to APAC

Following four years in tenure, UK chief executive Naidu will join the Zurich Group Executive Committee to take over as regional chief executive of the Asia Pacific region from the 1st January 2021.

-

News

NewsTrue impact of lockdown reductions not shown in ABI’s claims data says By Miles

Pay-per-mile insurtech By Miles has pointed out the ABI’s new quarterly motor claims data that was published today does not demonstrate the true impact of lockdown reductions in claims. The insurtech said that it could therefore include potential “red herrings” for some of the values of claims that have ...

-

News

NewsModern slavery risks surge in Asia manufacturing hubs

The risk is set to intensify further as the economic fallout from COVID-19 takes full hold, warns Verisk Maplecroft. Bangladesh, China, Myanmar, India, Cambodia, Vietnam and Indonesia are all at their lowest points in the ranking since 2017

-

News

NewsMNK Re launches dedicated Residual Value Insurance Centre of Excellence

MNK Re Limited, a specialist Lloyd’s Broker headquartered in London, has announced the launch of a dedicated Residual Value Insurance (RVI) Centre of Excellence. Based in London, Robert Prince has joined MNK Re as Practice Leader to specialize in RVI business exclusively. Robert has over 20 years of experience in ...

-

News

NewsFlood Re chief exec outlines next steps for addressing climate change risk

Flood Re’s chief executive Andy Bord outlined what should happen next to ensure that it can address climate change and reach a risk-reflective home insurance market by its exit in 2039. The flood re-insurer presented evidence to Parliament’s Environment, Food, and Rural Affairs (EFRA) Select Committee yesterday addressing the evolving ...

-

News

NewsABI records 48% decline in motor claims between 2020’s Q1 and Q2

Trade body the ABI reported that new motor insurance claims fell by 48% in the second quarter of 2020, reflecting the national lockdown regime that was implemented to mitigate the spread of Covid-19. Across April, May and June, the ABI recorded 324,000 new motor insurance claims compared to 678,000 claims ...

-

News

NewsLloyd’s of London becomes target for climate campaigners as underwriting room reopens

As Lloyd’s of London reopens its underwriting room today, campaigners voiced their concerns at its doors, urging the insurance marketplace to drop insurance and investments in coal and tar sands projects. Lloyd’s of London workers were met with some climate protesters raising their concerns as they returned to work after ...

-

News

NewsFitch Special Report: APAC Insurance Regulators’ Response During Coronavirus Crisis

Fitch Ratings believes the prompt response by most insurance regulators across the APAC region will help insurers weather some of their key business risks during the coronavirus crisis. Some insurers’ capitalisation, earnings and liquidity positions could come under pressure from the financial-market disruption and economic strain caused by the pandemic.

-

News

NewsCapsicum Re to rebrand in order to align with broader broking business

Specialist reinsurance broker Capsicum Re announced today (1 September) that it will rebrand to Gallagher Re, effective from 1 October, in order to align Gallagher’s reinsurance arm with its global retail and wholesale broking operations. Gallagher’s broking and underwriting chief executive describes this change as the ‘next iteration’ of the ...

-

News

NewsAM Best Affirms Credit Ratings of Arab Orient Insurance Company

The ratings reflect gig-Jordan’s balance sheet strength, which AM Best categorises as strong, as well as its adequate operating performance, neutral business profile and marginal enterprise risk management (ERM). The ratings also factor in rating enhancement from gig-Jordan’s parent company, Gulf Insurance Group K.S.C.P. (GIG), reflecting the strategic importance of ...

-

News

NewsFRISS launches Insurance Is A Beautiful Thing campaign

FRISS, the leading provider of AI-powered fraud and risk solutions for P&C insurance companies, known for its creative approach toward the insurance industry, launched an international campaign to regain a feeling of pride in the insurance industry. “Because insurance is anything but boring,” says FRISS. Jeroen Morrenhof, CEO and Co-founder ...

-

News

NewsOne Concern Forms Strategic Partnership with Sompo for Resilience Solutions in Japan

One Concern, Inc., today announced a strategic partnership with SOMPO Holdings, Inc., aimed at bringing AI-enabled resilience solutions and disaster-risk reduction technologies to Japan. The non-exclusive agreement builds upon the companies’ successful pilot project in Kumamoto City, Japan. This week marks Japan’s annual national disaster prevention day, which commemorates the ...

-

News

NewsAustralia - Black Summer losses to reach A$5.4 billion

Insurance Council of Australia says more than 83 per cent of bushfire claims have already closed

-

News

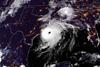

NewsHurricane Laura claims up to $8 billion

Cat modelling firms peg insurance losses from the Category 4 storm at between $4 billion and $8.7 billion

-

News

NewsGallagher and Pen Underwriting swap chief operating officers

Broker Gallagher has had a senior leadership reshuffle, sending the chief operating officer for its employee benefits and HR business to subsidiary Pen Underwriting, while MGA Pen provides the newest chief operating officer for Gallagher’s UK retail division.

-

News

NewsBriefing: Why insurance is key to economic recovery post-Covid-19

Insurance cover is a great enabler of economic activity, allowing businesses to carry out their trade, innovate and drive growth. Without that protection provided by policies, the risks for many would simply be too great. That is not to say that insurers can carry on operating in the same way ...

-

News

NewsAlphabet’s Verily targets employer health insurance with Swiss Re partnership

Alphabet Inc’s life sciences division Verily is partnering with reinsurer Swiss Re to launch a unit to provide stop-loss insurance, a financial product purchased by employers to cover unexpected and large employee healthcare costs.

-

News

NewsAon and Willis Towers Watson merger seals shareholder approval

Aon and Willis Towers Watson have announced that their respective shareholders have approved the merger of the two businesses at their extraordinary general meetings and at the special meeting of Willis Towers Watson shareholders ordered by the High Court of Ireland.

-

News

NewsMarsh subsidiary Torrent Urges Congress to Extend National Flood Insurance Program

In a new report published today, Marsh subsidiary Torrent Technologies, a flood insurance technology and servicing company and direct servicing agent of the National Flood Insurance Program (NFIP), highlights the need for public and private sectors to take collaborative action now to mitigate catastrophic flood risk.