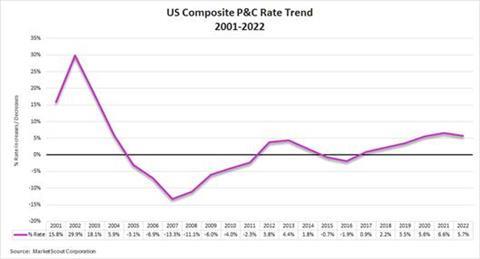

US commercial insurance pricing rose by an average of 5.7% in 2022, but there rates are beginning to moderate

The composite rate for US commercial insurance rates was up 5.1% in the fourth quarter of 2022. Annualised, the composite rate for 2022 is 5.7%, resulting in commercial rate increases for the sixth consecutive year.

The composite rate for all property insurance continues to be challenging with a rate increase of 9.3% in the fourth quarter. Certain cat-exposed commercial properties are being assessed increases as high as 25% to 30%.

Cyber insurance rates continue to increase the most aggressively at plus 20% in the fourth quarter. However, there is a trend towards slight moderation.

“On 1 January 2023, property cat reinsurance renewals were completed except in instances of poor underwriting and continuous losses,” said Richard Kerr, Founder of MarketScout and now CEO of newly formed Novatae Risk Group.

“Virtually everyone was assessed more restrictive terms and conditions. The trickle down will have a notable effect on the profits of property MGAs and program managers due to lower base commissions.”

Return to cash flow underwriting?

The National Alliance for Insurance Education and Research conducted pricing surveys used in MarketScout’s analysis of market conditions.

No comments yet