Global property and casualty insurers are set to maintain solid profitability and strong capital positions through 2026, despite subdued economic growth and persistent casualty and catastrophe loss trends, according to a new sector outlook from Moody’s Ratings.

The global property and casualty (P&C) insurance sector enters 2026 with a stable outlook, underpinned by strong earnings, conservative balance sheets and ample capital buffers, according to Moody’s Ratings.

Macroeconomic conditions are expected to remain challenging, but the rating agency argues that insurers are well positioned to absorb volatility and protect credit strength.

“Our outlook for the global property and casualty (P&C) insurance sector for 2026 remains stable,” the report said.

“While global economic growth is likely to be steady but remain subdued, insurers will maintain good profitability and strong capitalization, underpinning their credit strength.”

Subdued growth but supportive conditions

Moody’s said it expects global economic growth to hover at between 2.5-2.6% in 2026 and 2027, slightly below 2025 levels, reflecting policy divergence and trade shifts, particularly between the US and China.

Despite that slowdown, insurers are expected to benefit from easing inflation and reinvestment yields that remain well above levels seen during the low-rate era.

“Insurers in most regions will continue to benefit from reinvestment yields that exceed levels during the low-rate era, and generally easing inflation will slow growth in claims costs and other expenses,” the report said.

Investment income remains a key earnings driver, particularly for commercial lines carriers with long-dated assets.

Pricing supports profitability

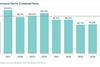

Moody’s expects profitability across both personal and commercial lines to remain solid in 2026.

Cumulative pricing increases over recent years have materially improved margins in personal motor and homeowners’ insurance, particularly in the US and parts of Europe.

“Cumulative pricing increases have improved profit margins for personal motor and homeowners insurance policies,” the report said.

“This will help insurers sustain solid profitability for personal lines in 2026.”

However, Moody’s cautioned that pricing momentum is beginning to slow as competition intensifies in markets where profitability has recovered most strongly.

In commercial lines, falling property rates are not expected to materially undermine earnings in the near term.

“Despite declining pricing for some commercial lines, such as property insurance, rates are still quite adequate following significant pricing increases during 2019 to 2023 and will support good profitability in 2026,” the report said.

Catastrophe and casualty swing factors

Weather-related losses and US casualty reserve development remain the largest sources of earnings volatility, Moody’s warned.

Moody’s highlighted the growing impact of secondary perils such as severe convective storms, floods and wildfires, noting that insured catastrophe losses have exceeded $100bn annually for several consecutive years.

“Insurers will continue to retain a large proportion of insured losses from high frequency, lower-severity weather events, often known as secondary perils,” the report said.

Declining property reinsurance costs are expected to ease margin pressure and may encourage insurers to buy more high-severity protection at the top of their programmes.

Casualty risk, particularly in the US, remains a concern.

“Insurers with significant US casualty businesses may need to boost their claim reserves and continue to raise rates as litigation persists and jury awards remain high,” Moody’s said.

AI adoption is accelerating

Moody’s also highlighted accelerating adoption of artificial intelligence (AI) across the P&C sector.

“We expect investment in AI and deeper integration of the technology to remain a strategic priority for insurers to improve operational efficiency and customer service,” the report said.

However, the ratings firm warned about challenges around data quality, model transparency and cyber risk.

Moody’s suggested these factors could also slow the pace of the P&C sector’s adoption of AI.

Strong balance sheets underpin credit strength

Balance sheet strength remains a core pillar of the stable outlook, according to Moody’s.

Moody’s said insurers continue to maintain liquid and conservative investment portfolios and remain well capitalized against potential large catastrophes and reserve volatility.

That strength is being reinforced by strong earnings and reductions in unrealized investment losses, although further significant improvements in capitalization are not expected.

Instead, excess capital is likely to be deployed through dividends, share buybacks and selective acquisitions.

Overall, the rating agency concluded that the sector remains well positioned heading into 2026.

“The stable sector outlook reflects our view of credit fundamentals in the global P&C insurance sector over the next 12 to 18 months,” Moody’s said.

“Strong capitalization, conservative investments and good profitability will continue to support insurers’ credit strength,” the paper added.

No comments yet