WTW grew its credit and political risk insurance portfolio by 25% last year, the broker has revealed in its CPRI Capacity Survey and Market Update 2024, but the market is increasingly turning to developed economies and multilaterals.

The Credit and Political risk Insurance (CPRI) market has made a clear pivot away from emerging markets, and towards more developed economies, according to WTW’s CPRI Capacity Survey and Market Update 2024.

The number of insurers in this space continues to grow year-on-year with a number of managing general agents and new entrant carriers coming into the CPRI space, the broker highlighted.

As the field becomes more crowded and more competitive, WTW said it is starting to see insurers specialise their offering to focus on sub-sets of the market, in order to retain market share and competitive edge.

The pivot away from emerging markets is due to their deteriorating credit quality.

“This is understandable as fiscal constraints and the spectre of losses continue to hang over emerging market economies,” said Stuart Ashworth, WTW’s head of broking and market engagement.

“That is not to say that insurance markets are not supporting the mobilisation of capital, but this is increasingly done through the support of multilaterals,” he said.

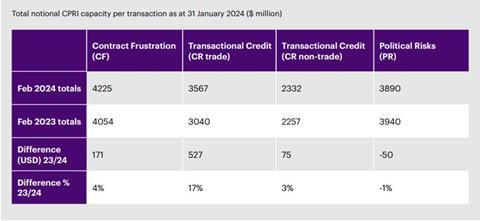

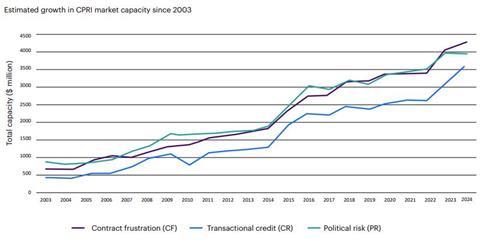

There was a modest 4% increase in contract frustration capacity vs 2023, and an increase of 17% for credit risk capacity versus 2023.

The only CPRI line to shrink backwards was PR, which saw a 1% decrease in available capacity compared with 2023, the report revealed. Geopolitical headwinds have caused some insurers to be less bullish, WTW noted.

WTW’s insured portfolio for CPRI grew by 25% in 2023, the broker revealed, suggesting the insurance industry is responding to product demand with increased capability and broader appetite.

On the demand side, an analysis of WTW’s in-house broking platform (which records data across the company from enquiry stage through to policy expiry, saw a 35% increase in enquiry submissions in 2023.

On the supply side, this demand was being addressed as the total capacity available for transactional credit insurance is rising 17% in 2024, after a similar rise in 2023, WTW said.

On claims, WTW described “a relatively benign claims year in 2023”, with no credit losses and surprisingly, given economic headwinds, there were relatively few files under credit watch.

Sovereign losses stood at $21.7m, according to WTW, and covered the last few instalments of claims relating to the 2020 Zambian government default, together with the beginning of claim collections on Sri Lanka and “more significantly” Ghana.

Political risk losses were up this year but still modest at $6.9m, but 2024 has started with an increase in loss activity over the same period last year “so it will be interesting to see how the year develops”, WTW observed.

“The geopolitical landscape is forcing a market-wide flight to quality. At the same time, insurers are facing elevated reinsurance rates and an ever-increasing risk landscape,” Ashworth said.

“These factors combined means that insurance companies are looking to support lines of business where they see strong historical returns as well as product diversification. CPRI appears to be well positioned to receive insurance company management support.

“However, that support is not universal and is more focused on certain risk areas, notably credit and contract frustration, and for the first time in many years, we have seen a drop in capacity and tenor appetite for political risks,” Ashworth added.

Click here to read the full report from WTW.

No comments yet