WTW ILS update shows continued investment

ILS investors are taking the fallout from the Q3 natural catastrophes head on, and continuing to make new investments, according to reports from Willis Towers Watson (WTW).

In the firm’s quarterly ILS market update, WTW found that while ILS investors were responding to the disasters by paying cedents, they were also raising more Monday and preparing to make more investments.

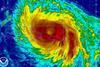

WTW outlined that although none of the Q3 notable events broke the $100bn loss mark, their aggregate losses are likely to, and for this reason the quarter would prove a true test to capitalisation: “None of the tragic natural catastrophes in the third quarter – two Mexican earthquakes and three Atlantic hurricanes – was individually of the $100 billion loss amount that might trigger a major shift in pricing. However, the aggregate losses from the quarter are likely to reach $100 billion. A magnitude that serves to remind the industry of the potential scale of losses it could face and providing an effective test of its capitalisation, ability to recapitalise and the resilience of the investor base.”

WTW Securities head of ILS Bill Dubinsky added: “Even though this is not ‘that year’, the recent loss activity will provide some clues as to what might happen when it does occur, and we can say that so far ILS investors and traditional reinsurers have performed well, supporting insurers to serve their policyholders. In particular, I would point to the Mexican government’s FONDEN bond where the class A notes may see a total loss of principal, delivering $150 million of disaster relief where it is vitally needed.”

No comments yet