All Africa articles

-

News

NewsAM Best: Sub-Saharan reinsurers post strong results despite economic headwinds

Report from AM Best says the region’s reinsurers achieved double-digit returns on equity in 2024, supported by disciplined underwriting despite macroeconomic volatility

-

News

NewsSouth African business ‘favours reinsurers’ – ASR’s Paradine

South Africa remains favourable for property reinsurers, while softening has been limited for other African business, according to ASR’s head of treaty

-

News

NewsDWIC 2025: Africa’s insurance leaders call for local partnerships and patient capital

Panel discussion in Dubai highlights challenges and opportunities across a diverse continent.

-

News

NewsEl Bahtouri and Bouanani join Specialty MGA in Casablanca

Laila El Bahtouri and Mohamed Bader Bouanani join the Middle East and African focused MGA from Moroccan reinsurer SCR.

-

News

NewsParametric expanding in Africa and ILS markets – GC&C’s Edwards

Simon Edwards leads parametric underwriting at Generali Global Corporate & Commercial (GC&C) in the UK, including an expanding partnership with Descartes Underwriting.

-

News

NewsASR launches first Africa focused Lloyd’s consortium

Baobab will work across political risk, trade credit, political violence & terrorism, property, energy, construction and liability lines.

-

News

NewsASR Middle East starts operating via Lloyd’s Dubai

Africa Specialty Risks Syndicate 2454 is operating through its service company in the Dubai International Financial Centre.

-

News

NewsBMS Specialty rehires Phillips as African practice leader

The specialty broking arm of BMS makes a return hire, who rejoins from Afro Asian Insurance Services, where he was group CEO.

-

News

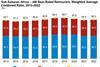

NewsPositive pricing dynamics benefit MENA and SSA reinsurers – AM Best

Two reports from rating agency AM Best give an upbeat summary of the market environment for reinsurers in the regions of Middle East and North Africa (MENA), and Sub-Saharan Africa (SSA).

-

News

NewsASR launches first Africa-focused Lloyd’s syndicate

Africa Specialty Risks Syndicate 2454 will focus on African risks, which currently make up only 2% of the Lloyd’s market.

-

News

NewsChedid Capital buys remaining 20% stake in Groupe Ascoma

The Middle Eastern re/insurance broker moves to further cement its position in Africa’s insurance market.

-

News

NewsAfrica Specialty Risks launches at Lloyd’s with Apollo

ASR Syndicate 2454 aims to begin underwriting in March 2024, and will focus on underwriting business across Africa, which represents around 2% of Lloyd’s business globally.

-

News

NewsAM Best publishes reports on MENA and Sub-Saharan African reinsurers

The rating agency reports that reinsurers across MENA and Sub-Saharan Africa report topline growth, despite persistent or heightened economic challenges.

-

News

NewsDjibouti signs five-year disaster risk financing deal with ARC

Deal to protect climate-vulnerable communities in the Horn of Africa covers drought and excess rainfall

-

News

NewsAfrica Specialty Risks approved as a Lloyd’s coverholder

ASR will begin by offering Political Violence and Terorrism cover across 47 African countries

-

News

NewsClimate change ‘most pressing issue’ for African insurers - CEO survey

Financial risks are topping the list of challenges facing the 54 African economies in the year ahead

-

-

News

NewsJBA and Reinsurance Solutions join forces to support African insurers for flood risk management

Nikki Pilgrim, Technical Director at JBA, explains: “The launch last year of our global flood modelling capability, driven by JBA’s FLY Technology, was a breakthrough opportunity that has allowed JBA and our clients to fill geographic gaps in traditional modelling.

-

News

NewsRokstone receives cover holder licence to underwrite in Africa

Rokstone, the international speciality (re)insurance MGA, part of Aventum Group, has announced it has secured an Insurance Agent Licence from the Financial Services Commission in Mauritius (FSC) and is now fully authorised to underwrite business directly in Africa from its office in Mauritius. Brokers across Africa can now access world ...

-

News

NewsTech investors eye Africa's education and financial sectors

Governments on the continent should instead be offering incentives for tech start-ups, Abass said, due to their potential to drive up traditional businesses like insurance.