Tensions between insurers and aggregators will likely increase amid the FCA pricing crackdown

By content director Saxon East

“Listen, here’s the thing. If you can’t spot the sucker at the first hour of the table, you ARE the sucker,” says young poker player Mike McDermott in the hit film Rounders.

If motor and home insurance is a game of poker, with intermediaries, service providers and insurers - then the loser at the table is the insurer.

They have the lowest profit margins, struggle to make underwriting profits and face ever-increasing pressures to give away even more of the premium to distribution.

And one player in the distribution chain applies ever greater pressure on them - the aggregators.

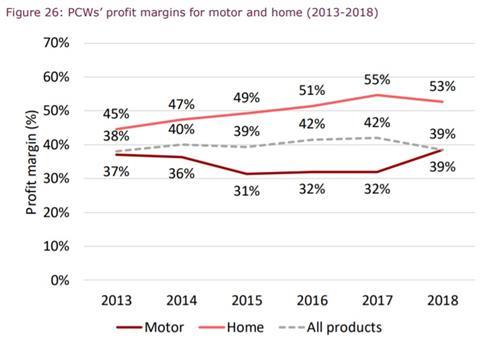

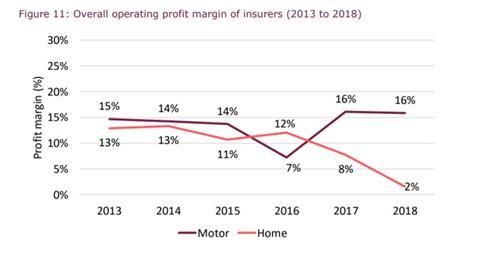

Aggregators make an incredible 53% profit margin on home insurance. Insurers make just 2%.

Look at the comparison of graphs below, taken from the FCA’s investigation into pricing practices last year.

The top one is price comparison sites and the bottom insurers.

But here’s the thing: the squeeze on insurers will likely get tighter.

Let me explain.

Cost and FCA pressures

In its pricing reform consultation paper last month, the FCA specifically highlights price comparison sites as vulnerable to lower revenues.

The logic is as follows: if customers are moving around less - because there is less incentive if new and renewal premiums are priced matched - then that means less churn and less revenue for price comparison sites.

So it’s clear that price comparison sites face a very real pressure from the regulatory reforms under consultation.

There is also another pressure. Price comparison sites revenues have gone up, but costs have also gone up considerably.

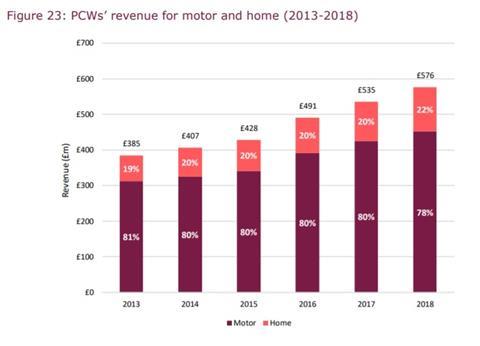

More money is going to marketing, advertising and direct paid search costs (see graph below from FCA data published last year on pricing practices).

Despite these increasing costs aggregators face, profit margins have risen in both home and motor from 2013 to 2018 (as the first graphic shows).

How have they achieved this? One factor is that they are getting more money from insures (and intermediaries).

Cost per acquisition has increased 13% between 2013 and 2018, according to the FCA.

Revenue has also risen (see below) as, quite simply, more and more people use price comparison sites, meaning naturally there will be more costs, such as staff expenses.

In summary, price comparison sites have maintained profit margins and increased sales.

Now here’s the problem.

If the FCA’s reforms lead to less churn and then less revenue - but aggregators struggle to reduce costs amid all the essential pressures to mantain direct paid search and advertising, allied to required staffing - then price comparison sites will have to find ways of making more money from insurers (and intermediaries).

This will be quite painful for some insurers, who themselves may well face lower revenues.

Remember, the FCA estimates up to £11bn in lost revenue across all insurance firms in the next ten years.

Resisting the price comparison websites is difficult for insurers: the aggregator market is dominated by several players.

Insurers do not have many other places they can turn to.

Insurers could follow the route of Saga, trying to push customers direct to their websites, but this will mean increased advertising and marketing costs.

The aggregators are not necessarily the villains at work: they are profit-making enterprises highly adept at maximising their revenues from partners. It is up to the insurers to find another way if they don’t like dealing with them.

In fact, the FCA in the latest consultation praises aggregators as providing an important and helpful service to customers.

But away from the customer, the tensions between price comparison sites and insurers are likely to ratchet up another notch amid these market-changing regulatory reforms.

Want to subscriber and read more of our content? Click here to find out how.

Briefing Saxon East: Broker profits are serioiusly threatened by FCA premium finance crackdown

No comments yet