Reinsurance renewals in January 2024 saw a market adjusting to a period of extraordinary cyclical and structural change, according to Howden’s briefing.

Re/insurance broking group Howden released its “A New World” summary of the 1 January reinsurance renewal, characterising the market as stable and broadly flat due to “more favourable supply dynamics”.

The market is adjusting to a period of extraordinary cyclical and structural change, according to Howden, but the result look remarkably flat, in contrast to events just a year ago, which Howden calls “The Great Realignment”.

Market conditions have improved in the following 12 months, with supply “more than sufficient to meet demand”, the intermediary suggested.

The 1/1 renewal yielded stable risk-adjusted rate movements at 1 January 2024: retrocession was seen as flat; global direct and facultative was flat; global property-catastrophe was up just 3% adjusting for risk , and London Market casualty was also flat.

The briefing highlighted nuanced conditions across the re/insurance market, reflecting new macroeconomic and geopolitical realities and reset loss expectations.

“Risks are escalating as the world lurches from one crisis to another. The value of risk transfer comes to the fore during such volatile times,” said David Howden, founder and CEO, Howden.

Improved supply dynamics nevertheless suggests sentiment is now shifting, the paper noted, as pricing momentum across different areas of the market drives improved performance and increased appetite to deploy capacity.

“This is the moment for brokers and carriers to step up and apply our intellectual and financial capital to find creative solutions that safeguard the insurability of assets exposed to a myriad of risks, including climate change, geopolitical instability and rapid technological advancements,” David Howden continued.

Renewals took place in an environment of more favourable supply dynamics, but also underwriting discipline. The result was a relatively stable and orderly renewal, with supply more than sufficient to meet increased demand, according to the report.

Risk-adjusted pricing saw flat changes overall, and any significant variation by territory or line of business was informed by loss experience.

Capacity for frequency protection was once again at a premium, but competition further up programmes brought better outcomes. Terms and the scope of coverage were a core focus in 2024, which resulted in improved concurrency overall. Capital inflows supported more favourable market conditions, the broker said.

“The reinsurance market has stabilised after last year’s exceptionally challenging renewal,” said Tim Ronda, CEO of Howden Tiger, the reinsurance broking arm of the group.

“Reinsurers were relatively unscathed by large losses in 2023, due in part to more favourable terms and conditions, including higher risk retentions and attachment points. Returns are back at equal to, or greater than, reinsurers’ cost of capital,” Ronda said.

“Activity in the lead-up to 1 January was timely and orderly, and our clients are in a better position to understand their cost of reinsurance and volatility within their retention. It seems we are in a period where stability is rewarding both clients and reinsurers,” he added.

“Dedicated reinsurance capital has recovered to near record levels. Generationally strong pricing, favourable terms and conditions in key lines of business and pursuant, higher returns on capital have enticed capacity back into the market through multiple channels,” said David Flandro, head of industry analysis and strategic advisory, Howden Tiger.

“This, combined with a rapid recovery in traditional balance sheets has meant there was excess capacity for some placements. The structure of the reinsurance market continues to change, with alternative capital now comprising nearly a quarter of the total,” Flandro said.

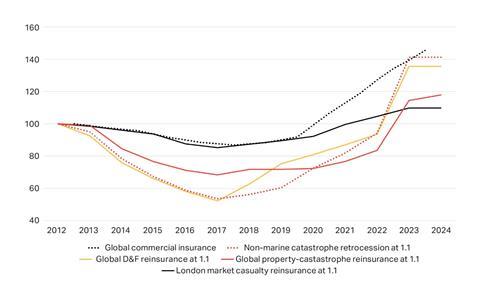

The chart below shows the Howden pricing index for primary, reinsurance and retrocession markets from 2012 to 2024 (Source: NOVA).

Prop cat & ILS

Global risk-adjusted global property-catastrophe reinsurance rates-on-line rose by an average of 3% at 1 January 2024. This was down considerably on the +37% recorded in 2023, Howden observed. Increased appetite from most markets meant supply was able to meet demand to a degree that was lacking last year.

The rebound in the ILS market was an important factor as competition increased for higher-attaching layers, which in turn encouraged new sponsors to enter the market. Terms and coverage scope remained largely stable, although there was a notable shift towards concurrency.

Insured catastrophe losses exceeded $100bn for the fourth straight year in 2023, Howden said, indicating an elevated baseline for loss expectations. The lion’s share of these insured losses were borne by insurers, following reinsurers’ structural retreat from frequency risks through 2023’s renewal cycle.

US renewals at 1/1 reflected improved supply dynamics, with reinsures willing to support terms and pricing levels broadly aligned to those established during last year’s renewals. The broker said capacity continued to be restricted for lower layers, but increased competition further up programmes, driven in part by the ILS market, brought more attractive pricing for mid-to-top layer risks. Risk-adjusted pricing remained stable as a result, moving within a range of down 5% to up 5%, Regional carriers exposed to severe convective storm losses saw substantial increases.

In Europe, loss experience and inflation shaped prop cat renewals, according to Howden. More favourable supply dynamics helped to moderate overall pricing increases to low- to mid-single-digits. Efforts to restructure programmes, begun in earnest during renewals last year, were extended at 1 January 2024 to countries that escaped adjustments and made sizeable reinsurance recoveries in 2023, including Italy, Turkey and Slovenia. Double-digit risk-adjusted pricing increases were typical in these territories. Capacity was nevertheless sufficient to see deals over the line.

Retro market

The absence of major losses in 2023, favourable development for Hurricane Ian and increased capital inflows towards the end of the year yielded stable retrocession renewals at 1/1. Whereas last year’s dislocated renewal reflected trapped capital and long-standing investor fatigue, improved performance in 2023 put pressure on price and signings.

Risk-adjusted retrocession catastrophe excess-of-loss rates-on-line were flat at 1/1. Low-attaching occurrence layers and aggregate covers continued to suffer from a lack of supply, while strong competition further up programmes resulted in favourable outcomes for cedents, with modest risk-adjusted reductions achieved in certain instances. Strong investor appetite saw catastrophe bond pricing fall in the 10% range and remain at attractive levels for both buyers and sellers.

Casualty stable

Sufficient capacity and market discipline characterised casualty reinsurance renewals at 1/1, Howden said.

“Certain reinsurers” had “talked-up the need to push for wholesale action” in the lead up to negotiations, citing economic and social inflation, and reserve adequacy, but the broker said outcomes ultimately reflected more discerning underwriting informed by loss experience, underlying rate change and prior-year development across individual portfolios.

London market casualty reinsurance excess-of-loss rates remained stable at 1 January 2024. Outlier outcomes were driven by individual account performance rather than overriding market sentiment. Ceding commissions came under pressure for accounts with U.S. exposures. Several programmes saw decreases in the range of one to two percentage points, with steeper reductions for those that have not performed so well or where underlying pricing deteriorated.

Direct and fac

The direct and facultative (D&F) reinsurance market once again supported clients renewing programmes at 1/1 following a year of strong growth and favourable loss experience, including reduced loss expectations for Hurricane Ian.

Demand for D&F catastrophe cover remained robust, Howden noted, driven by higher rates and premium on original business, higher insured valuations on original business and the attendant need for additional limits.

Following a major pricing correction at last year’s corresponding renewal, rate movement in 2024 was flat on a risk-adjusted basis. A cumulative increase of 160% since 2017 has kept pricing levels close to where they were last year and above those recorded in the aftermath of Hurricane Katrina. The underlying market has benefitted from similar pricing tailwinds during this time, the broker added.

No comments yet