Two decades after hurricanes Katrina, Rita, and Wilma reshaped the reinsurance landscape, Ariel Re’s CEO Ryan Mather reflects on the reinsurer’s origins, the pivotal moments that shaped its journey, and why a culture of analytics and due diligence gives it its competitive edge.

When hurricanes Katrina, Rita, and Wilma tore through the Gulf Coast in 2005, they left in their wake not only devastating insured losses but a wave of new capital and fresh reinsurance ventures.

Ariel Re was one of them. Formed in Bermuda in the frenetic months between that August and year-end, the company’s foundations were laid at speed – but with a deliberate focus that Ariel Re’s chief executive Ryan Mather says still defines it today.

“It was a crazy time,” he recalls. “Post-9/11 we’d had the class of 2002, who’d done very well. In 2004, four storms hit Florida, which was tough for some.

Going into 2005 no one was sure of the market direction – we thought it might go south. Then Katrina happened at the end of August, and that really was the backdrop for Monte Carlo in 2005.”

With Rita and Wilma following in September and October that set the tone of the cat market for the next five years.

At the time, Mather was head of international catastrophe at Rosemont Re, a small and undercapitalised operation.

Rosemont’s CEO, Russell Brooke, connected with Don Kramer – a serial industry entrepreneur who had just left ACE as vice-chairman.

Kramer had raised capital before, founding Tempest Re with $500m after hurricane Andrew in 1993, and set out to do it again.

“We had six weeks to get one billion dollars of capital, a rating, and a team,” Mather says. “Don being Don, he attracted great people from ACE and Tempest, as well as from Rosemont. On day one – around 15 December – we had a team of 16, led by Don and founding president George Rivaz.

“From that day, we had a very recognisable culture, rooted in analytics and risk management.”

That culture was more cautious than some of the other “Class of 2005” peers. Ariel Re wrote just $150m of premium in its fi rst year on $1bn of capital – the lowest among the cohort.

“We were initially nervous others were going to get away from us,” Mather admits. “But our combined ratio was about 42% in year one, and 39% in 2007. We resisted chasing volume, even in a hard market, and that paid dividends later.”

It was, he says, “a game of two halves”: the first marked by frantic capital raising after Katrina, Rita, and Wilma; the second by measured execution of a strategy focused on underwriting discipline.

The early lesson was clear: “Do your diligence on risk before the line goes down, not after the loss. It’s much more painful to learn about the risk afterwards.”

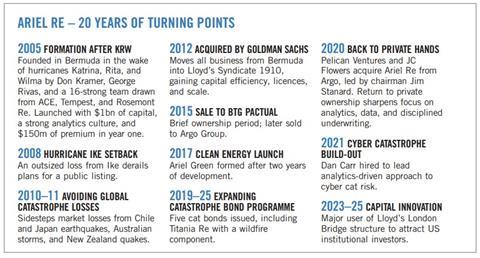

Ariel Re’s 20-year history has been punctuated by changes in ownership, strategy and market shocks. These “punctuation marks”, says Mather, have defi ned the company’s trajectory.

In 2012, investment bank Goldman Sachs acquired the firm, introducing it to Lloyd’s via Syndicate 1910.

“That completely changed our direction,” Mather says. “We moved all our business from Bermuda to Lloyd’s, gaining scale, capital efficiency, and licences, while avoiding some of the rating agency pain.”

Other owners followed – BTG Pactual, briefly, then Argo – before a 2020 sale to Pelican Ventures and JC Flowers, led by chairman Jim Stanard, founder of RenaissanceRe.

That deal brought Ariel back into private hands, which Mather says allowed it to “go back to our core – strong risk management, analytics, data – and really up our game to become a leader and an important capacity provider on the world stage”

External events have also shaped the business. Hurricane Ike in 2008 delivered an “outsized loss” that derailed IPO plans. By contrast, in 2010–11 Ariel avoided major losses from Australian storms and powerful earthquakes in Chile, Japan, and New Zealand, thanks to its view that these perils were poorly understood and underpriced.

He attributes such moments of conservatism to an overall balanced risk culture. “Culture is absolutely key to running a business,” Mather says.

To use a football analogy “You can’t have 11 strikers – you need the right mix of skills, a common ambition, and people who know their role. A great team never goes out of fashion.”

While some peers have diversified widely, Ariel Re has chosen to concentrate on just four specialist lines: Property Catastrophe, Cyber Catastrophe, Marine and Specialty and Clean Energy business. “We want to be the best in the world at the four lines we’ve chosen, not a little bit good at lots of things,” Mather says.

Cyber catastrophe is a relatively new line, led by Dan Carr, a former UK Ministry of Defence analyst with a focus in cyber disaster scenarios.

“We put him together with our cat modelling background to create a view of cyber risk we think is reasonable,” says Mather. “We’re still in the early days, but it could become a very meaningful line – maybe one day overtaking property and casualty.”

Clean Energy, branded Ariel Green, began in 2017 after two years spent developing models and wordings before selling a single policy, he explains. “It’s proven to be low frequency,” he notes. “High severity hasn’t been tested yet – time will tell.”

Property Catastrophe remains core for the reinsurer, evolving with more sophisticated models, new datasets and increasingly, by AI. Ariel Re is experimenting with large language models and AI to improve data handling, modelling, and operational leverage.

“If we use it wisely, it will positively impact our loss ratio and expense ratio,” Mather says.

Meanwhile, Marine and Specialty business is shaped by world trade flows and can be jolted by geopolitical or legal developments, such as the recent UK High Court ruling on war risks related to Ukraine.

Ariel Re has been active in the catastrophe bond market, with its fifth issue – Titania Re – incorporating a wildfire component.

“We’re always trying to be at the forefront,” Mather says. “Wildfire is a peril we’re all trying to understand better. After the LA losses this year, we thought including a small amount of exposure would focus attention.”

The series name comes from A Midsummer Night’s Dream, staying in keeping with Ariel’s Shakespearean etymology, as the spirit in The Tempest (the plot of which was inspired by a 1609 shipwreck off Bermuda’s coast).

Across the pond, Ariel Re is making use of Lloyd’s of London’s London Bridge II vehicle to bring in further institutional third-party capital, especially from US investors benefiting from UK-US tax treaties.

“Innovation doesn’t have to be revolutionary,” Mather says. “It’s about using all the tools available to capitalise the business efficiently, with multi-year capacity that lets us plan ahead.”

As the Monte Carlo Rendez-Vous approaches, Mather describes a market shifting from “risk off” to “risk on” and facing renewed competition for limited new business.

“The catastrophe market is coming off the top, but in historical terms it’s still super attractive – maybe an eight or nine out of 10,” he says.

Climate change is pushing perils such as wildfire and flood higher up the agenda, Mather observes.

“We want to be at the forefront, but only if we’ve got control of the models and understand the peril,” he says.

As for the next 20 years? “The world will develop opportunities for us. We weren’t in cyber four years ago. We weren’t in clean energy seven years ago. We’ll be in new things – we just don’t know what they are yet. “It’ll be driven by a market opportunity, a talent opportunity, or both.”

To download the full Monte Carlo RVS 2025 annual issue of GR, click here.

No comments yet