The protection gap deteriorated to 69% last year, from 58% in 2022, with insurance covering the cost of $118bn of $380bn in economic losses.

Aon has published its 2024 Climate and Catastrophe Insight report, revealing insured cat losses of $118bn in 2023 and economic losses that reached $380bn.

This represents a protection gap of 69%, the broker said, highlighting the human cost of 95,000 fatalities, for the deadliest year since 2010.

The paper identifies global natural disaster and climate trends to help make better decisions to manage volatility and enhance global resilience.

Some 398 global natural disaster events caused a $380bn of economic losses, up from $355bn in 2022.

Last year’s event toll was 22% above average for the 21st century thus far, driven by significant earthquakes and relentless severe convective storms (SCS) in the US and Europe.

Global insurance losses were 31% above the 21st-century average, exceeding $100bn for the fourth year in a row.

With insurance covering only $118bn, down from $151bn in 2022, or 31% of total losses, the protection gap stood at 69%, deteriorating from 58% in 2022.

The number of large-loss natural hazard events reached record levels in 2023, with 66 billion-dollar economic loss events, and 37 billion-dollar insured loss events.

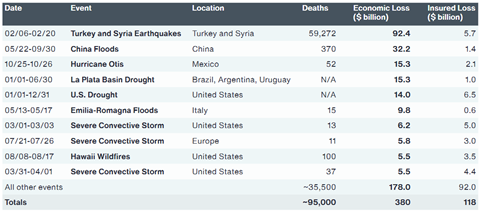

Earthquakes caused the most economic losses, while severe convective storms were most costly to insurers. New Zealand, Italy, Greece, Slovenia and Croatia all recorded their costliest weather-related insurance events on record.

The report highlights that 95,000 people globally lost their lives due to natural hazards in 2023 – the highest number since 2010 – resulting largely from earthquakes and heatwaves.

In terms of climate, 2023 was the hottest year on record with ‘unprecedented temperature anomalies’, and all-time highs observed in 24 countries and territories.

“Amidst increasing volatility and complexity, there is a significant opportunity for organizations to become more resilient to the climate and catastrophe risks highlighted in our report,” said Greg Case, CEO of Aon.

“By working across the private and public sector we are accelerating innovation, protecting underserved communities and better addressing the economic impacts of extreme weather to create more sustainable outcomes for businesses and communities around the world.”

Andy Marcell, CEO of risk capital and CEO of reinsurance at Aon, added: “The findings of the report highlight the need for organizations – from insurers to highly impacted sectors such as construction, agriculture and real estate – to utilize forward-looking diagnostics to help analyze climate trends and mitigate the risk, as well as protecting their own workforces.

“Risk managers can take advantage of increasingly sophisticated tools and leverage analytics to unlock capital and make better decisions. Equally, the insurance industry plays a critical role in improving the financial resilience of communities within their portfolios and taking the opportunity to bridge the protection gap with new and relevant products.”

With efforts to limit global warming, Aon suggested investors can consider climate change from three perspectives: protecting their portfolios against financial risks; benefiting from growth opportunities in climate solutions, and determining how to have a positive impact and play a role in a world moving to net-zero.

“The report highlights how communities can be vulnerable to disasters in different ways. For example, earthquakes in 2023 highlighted underinsurance and the importance of regulation and enforcement of building codes,” said Michal Lörinc, head of Catastrophe Insight at Aon.

“In addition, deadly floods – notably in Libya and India – reinforce the necessity for proper maintenance of infrastructure while the Hawaii fires demonstrated the critical need for reliable warning systems and forecasting.”

Here’s a chart showing the top 10 global economic loss events in 2023, according to Aon. The full report can be found here.

No comments yet