Insurers buying protection at midyear renewals benefit from improved pricing, terms and conditions as global reinsurance capital exceeds $720bn, according to reinsurance broker Aon.

Reinsurance buyers entered the June and July 2025 renewals in a stronger bargaining position than they have enjoyed in years, according to Aon.

The broker used its Reinsurance Market Dynamics Midyear 2025 Renewal report to show a continued shift towards buyer-friendly conditions amid record levels of industry capital and resurgent investor appetite.

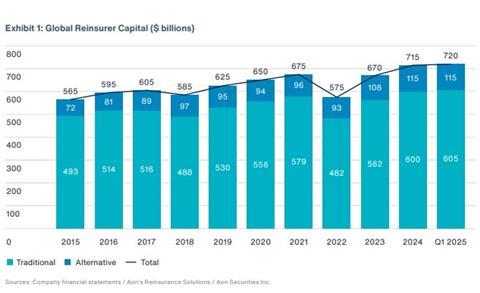

Global reinsurance capacity surpassed $720bn in the first quarter of 2025 (see first chart), up from $715bn at year-end 2024, according to the reinsurance broker, creating a competitive environment even in the face of elevated catastrophe losses.

According to its renewals study, the ample capital, driven primarily by retained earnings and buoyed by alternative capacity from catastrophe bonds, allowed insurers to push for improved pricing, broader terms, and new coverage options.

“The current reinsurance market conditions create opportunities for insurers to address specific issues, or to adjust program structures and coverage to reduce volatility in both property and casualty,” said Steve Hofmann, US CEO of Aon Reinsurance Solutions.

Cat bond boom

A defining feature of the midyear renewals was the record-breaking activity in the insurance-linked securities (ILS) market, Aon reported.

Catastrophe bond issuance totalled more than $16.8bn in the first half of 2025, including the two largest transactions ever seen in the market, each topping $1.5bn.

The outstanding size of the cat bond market is now on pace to grow by $7.2bn in H1 alone—a 15% rise since year-end 2024.

This surge in alternative capital is reshaping the reinsurance landscape. “Alternative capital has become an increasingly important component of the overall property catastrophe reinsurance limit purchased by cedants,” Aon observed, noting strong investor returns and tightening spreads even amid unprecedented issuance volumes.

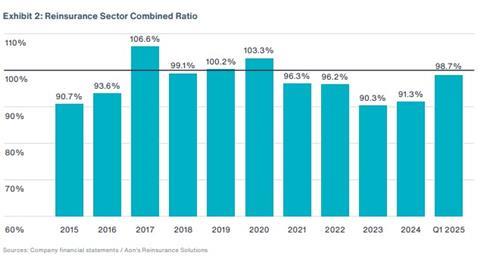

Traditional capital also held firm, the broker suggested. Despite a $40bn loss from January’s California wildfires and an estimated $60bn in insured catastrophe losses in Q1—second only to Q1 2011—most major reinsurers delivered strong financial results.

Two-thirds posted double-digit returns on equity, and the sector’s average combined ratio for Q1 stood at a still profitable 98.7% (see chart below).

Competitive tension

While the overall environment favoured buyers, Aon said, outcomes varied depending on performance and geography. US insurers benefitted most, especially those with clean loss records.

Loss-free placements in property catastrophe achieved low double-digit risk-adjusted rate reductions.

Meanwhile, loss-impacted programmes saw flat or even increasing rates, particularly in California and regions affected by recent severe convective storms and wildfires.

Florida stood out as a success story, according to Aon. Reforms to the legal system, improved building codes, and legislative action on Citizens, the US state’s insurer of last resort, helped stabilise the market.

More than 600,000 Citizens policies have been transferred to private insurers since 2023, increasing demand for limit, but reinsurers responded with greater flexibility and moderate price reductions.

“The market’s performance following [recent hurricanes] gave reinsurers confidence in the changing fortunes for Florida’s property insurance market going forward,” the report said.

In Latin America and the Caribbean, the market stabilised after the hardening of 2023-24. Ample capacity and benign natural catastrophe loss activity allowed for modest rate reductions and a wider acceptance of facultative and proportional solutions.

The flood-prone Brazilian market saw an uptick in cat limit purchasing, fuelled by recent events and bolstered by a new Aon flood model for the region, the report noted.

Australia and New Zealand also benefited from increased capacity and subdued cat losses. Cyclone Alfred, though impactful, was largely absorbed by the region’s new government-backed reinsurance pool, Aon observed.

Rate reductions in the high single or low double digits were common, with interest growing in structured and aggregate solutions, the broker said.

Casualty and cyber markets

The casualty sector held relatively stable, the broker observed. Reinsurers remain alert to litigation trends and nuclear verdicts but continued to support well-managed portfolios.

“Casualty insurers entered the midyear renewals in a relatively strong position,” the report noted, with reinsurers recognising “the upside of relatively high interest rates, strong underlying casualty pricing and the prospect of tort reform”.

Cyber insurance, meanwhile, showed signs of innovation.

Aon placed a pioneering stop-loss cover protecting against surges in claims from events not tied to a single defined incident—an evolution prompted by recent systemic cyber losses.

Pricing was broadly favourable, and capacity remained abundant, though margin pressures are emerging as underlying insurance rates soften, Aon added.

2026 and beyond

Aon encouraged insurers to capitalise on current conditions while preparing for potentially less forgiving markets in the future.

“All things being equal, reinsurance market conditions are likely to remain favourable for the foreseeable future,” Hofmann said.

Persistent volatility remains a threat, he warned, citing geopolitical risks, social inflation, and an above-average forecast for the North Atlantic hurricane season.

Reinsurers, in turn, are pursuing selective growth, particularly in property catastrophe and structured solutions.

Competitive tension is most intense in the middle layers of programmes, where both traditional and alternative capital are vying for share, Aon suggested.

“We must continue to work collectively to create the solutions necessary to sustain a healthy re/insurance market,” the broker added.

The full report can be found here: Reinsurance Market Dynamics Midyear 2025 Renewal

No comments yet