Rating agency Moody’s sees little immediate threat to European insurers from recent banking turmoil.

Europe’s insurers are insulated from turmoil involving banks, according to Moody’s, in the wake of the March 2023 rescue of Credit Suisse by Swiss regulators and rival bank UBS.

Moody’s sees little immediate risk to European insurers, as the prompt regulatory response has reduced the risk of severe systemic financial strain.

The bank bond holdings of European insurers rated by Moody’s are also of moderate size, the rating agency said, and their exposure to riskier Additional Tier 1 (AT1) instruments – hybrid bonds designed to convert into equity, also known as contingent convertibles (Cocos) – is negligible.

“We estimate that the average AT1 exposure of Moody’s rated insurers is less than 1% of their total bank debt holdings, with some variation between companies. AT1 bonds are riskier than other bank debt because they are the most junior instrument in banks’ capital structure,” Moody’s said.

The insurance sector nonetheless faces an increased risk of asset quality deterioration, Moody’s warned, amid worsening economic conditions and rising interest rates, which could erode its earnings and solvency.

In light of recent trends, Moody’s said it expects the corporate default rate for speculative-grade financial and nonfinancial companies to rise to 4.6% at year-end 2023.

This is under the rating agency’s baseline scenario, up from 2.9% at the end of March, and expected to peak at 4.9% in early 2024.

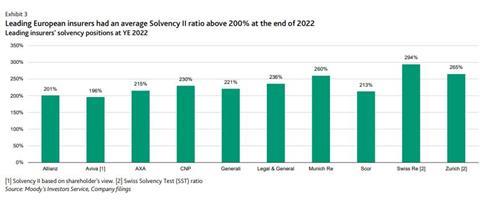

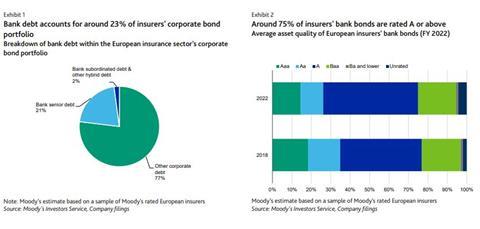

“We estimate that bank bonds account for around 23% of European insurers’ total corporate fixed income portfolios on average, down from around 30% shortly after the 2008 global financial crisis, and for around 8% of their total fixed income exposure,” Moody’s said.

“This is equivalent to around half their shareholders’ equity. About 75% of insurers’ bank debt was rated ‘A’ or above at FY2022, and a further 20% was rated ‘Baa’,” the ratings firm continued.

“AT1 exposures are negligible. We estimate that the average AT1 exposure of Moody’s rated insurers is less than 1% of their total bank debt holdings, with some variation between companies,” Moody’s added.

No comments yet