Rises in traditional reinsurance pricing have caused demand for alternative structures, especially cat bonds, according to a report from the rating agency.

Alternative reinsurance capital regained momentum in the first half of 2023, after four years of stagnation, a report from credit ratings agency Moody’s has noted.

The increase in funds invested in structures that allow investors to make a return by assuming reinsurance risk was shown in higher catastrophe bond issuance and bigger deal sizes, as rising traditional reinsurance prices pushed up returns from alternative capital, according to Moody’s.

The report, based on discussions with market participants at this year’s Monte Carlo reinsurance rendezvous, suggested growth “will remain moderate” because of investor concerns about climate risk, and limited use of alternative capital outside the natural catastrophe reinsurance market.

Key takeaways:

- Cat bond issuance drives growth in alternative capital

- Influx of alternative capital likely remain moderate

- Demand for alternative reinsurance capacity remains healthy

- Alternative capital to expand beyond prop cat, but slowly

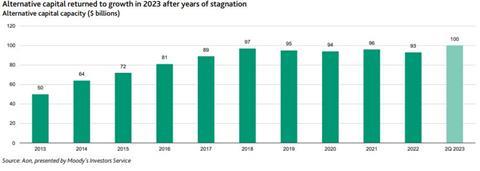

According to insurance broker Aon, total alternative capital reached around $100bn in

Q2 2023, up 8% from year-end 2022. This trend will likely continue into 2024, with cat bond issuance reaching new records, Moody’s suggested.

The increase marks a break with the 2017 to 2021 period, Moody’s noted, when alternative reinsurance capacity stagnated at between $93bn and $97bn as above average catastrophe losses weighed on returns.

“During this period, some cedants facing potential claims requested that the collateral backing their alternative reinsurance transactions be frozen until losses were finalised, leading to an increase in “trapped” investor capital,” the ratings firm said.

Citing Aon, Moody’s said collateralised reinsurance accounted for about 50% of the alternative capital deployed in H1 2023, and catastrophe bonds for a further 40%. Reinsurance sidecars and industry loss warranties made up the remainder.

The increase in total alternative capacity in 2023 largely reflected an increase in cat bond issuance, as rising traditional reinsurance prices encouraged cedants to seek other options.

Stronger prices in the traditional market supported cat bond yields in turn, enhancing their appeal to investors, who also value cat bonds’ high loss trigger points.

New cat bond issuance from the start of 2023 until mid-August reached a record high for the period of $10.3bn, exceeding the $10bn total for all of 2022.

In contrast to cat bond issuance, collaterised reinsurance, which has generated poor investor returns in recent years, has yet to recover, Moody’s stressed.

“This is because it is activated at lower loss levels than catastrophe bonds, which makes it vulnerable to increasingly frequent “secondary perils” - extreme weather events such as floods and wildfires that are less costly but more frequent than major catastrophes such as hurricanes,” said the report.

“With the frequency and severity of secondary peril losses rising again in the first half of 2023, further price rises and higher attachment points may be needed to make collateralised reinsurance more attractive to investors,” it continued.

Healthy demand for alternative reinsurance capacity

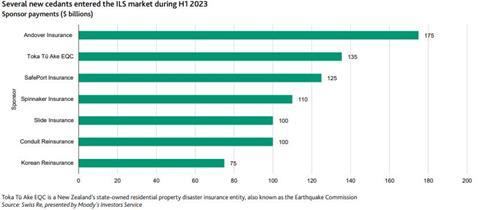

During the first half year of 2023, seven new cedants entered the market for insurance linked securities (ILS) seeking reinsurance protection against a variety of risks, including US wind and New Zealand earthquake, according to Moody’s.

This influx partly reflects a reduction in traditional reinsurance capacity following recent large catastrophe losses, according to the report, with some reinsurers exiting the property catastrophe market entirely.

The reduction in traditional reinsurance capacity has been accompanied by a rise in its cost, the rating firm noted.

According to Guy Carpenter, US and global property cat reinsurance prices have reached their highest level since 2009, having risen by more than 60% between the contract renewals of January and July 2023. This tallied with Moody’s own reinsurance buyer survey, which showed cedants expecting continued price increases for all forms of reinsurance globally in 2024.

“We expect primary insurers and reinsurers alike to complement their purchases of traditional reinsurance and retrocession with alternative capital structures at the January 2024 contract renewals,” Moody’s said.

“According to our survey, primary insurers are increasingly interested in collateralised reinsurance and catastrophe bonds compared with 12 months ago, while appetite for sidecars and insurance-linked funds is more limited,” the report continued.

“Initially a competitor to traditional reinsurance, alternative capital is now used extensively in the property catastrophe market by reinsurers themselves, forming an integral part of their risk and capital management strategies,” Moody’s said.

“Transferring risk via alternative capital allows reinsurers to limit earnings and balance sheet volatility and earn more stable fee income. It also helps them lower their total cost of capital, manage peak risk exposures, improve risk-adjusted returns and enhance their overall competitive position. We expect demand from reinsurers for alternative capital capacity to remain healthy into 2024,” the report added.

Influx of alternative capital will likely remain moderate

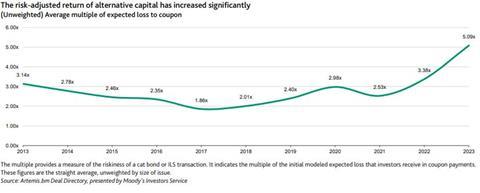

While rising interest rates have opened up a range of investment opportunities, we expect alternative reinsurance capital to remain attractive to investors because of its high and largely uncorrelated returns, and its relatively short duration.

The risk profile of ILS investments has also improved significantly as a result of higher prices, tighter terms and conditions, and higher attachment points (the loss threshold where reinsurance is triggered), mirroring developments in the traditional reinsurance market. ILS risk-adjusted returns hit a 20 year high during 2023, driven by lower expected loss trends as well higher nominal returns.

Investor caution regarding secondary perils is also reflected in slower inflows of capital into collateralised reinsurance structures. These typically have lower attachment points than catastrophe bonds, and are therefore more vulnerable to increasingly frequent secondary peril events.

Alternative capital market to expand beyond property catastrophe, but slowly

Alternative reinsurance capital has been deployed mainly in the property catastrophe market to date. This is partly because the large size of catastrophe claims often exceeds the capacity of traditional reinsurers, Moody’s observed, creating demand for additional coverage.

“Catastrophe risk is also well suited to the ILS format because losses can be modelled with a relatively high degree of accuracy, helped by abundant historical data. Moreover, the short duration (typically one year) of catastrophe reinsurance contracts is attractive to investors as it allows for rapid returns and regular re-evaluation of investment strategies,” Moody’s said.

“Investors are increasingly showing interest in cyber and casualty risks, which like catastrophe risk are becoming more expensive to reinsure. The cyber and casualty classes would add diversification to investors’ ILS exposure as they are typically uncorrelated with property catastrophe risk.

“Long-tail casualty risk could also offer better alignment with the long-term liabilities of investors such as pension funds, despite some uncertainty over how claims might develop over an extended period,” the report added.

Cyber reinsurance capacity falls short of supply

The cyber insurance market relies heavily on reinsurance protection, as demand for coverage surpasses the available supply. However, traditional reinsurers are cautious about the potentially systemic nature of cyber risk, particularly in the case of cyberattacks. As a result there is a substantial protection gap in cyber reinsurance which gives the cyber ILS market, currently at an embryonic stage, good growth potential, Moody’s observed.

Lloyd’s insurer Beazley sponsored the first cyber cat bond in January 2023 providing excess-of-loss coverage, and followed up with two further issuances in May and September. This, Moody’s said, has given Beazley an aggregate $81.5m of cyber reinsurance protection.

Hannover Re also ceded cyber risk to the capital markets in January, through a quota share cession, supported by New York-based Stone Ridge Asset Management with $100m of capital, Moody’s noted.

This was the first ever arrangement through proportional reinsurance enabling capital market investors to participate directly in covering cyber risks, “and illustrates the potential for more widespread use of cyber ILS”.

Moody’s said: “We expect continued growth in the cyber insurance market to steadily increase demand for cyber reinsurance, which will in turn drive growth in the cyber ILS space. However, the cyber ILS market faces obstacles in the form of under developed loss modelling, reflecting the man-made nature of cyber risk, and a limited historical claims data set. The cyber (re)insurance market would also benefit from greater standardization of coverage terms and policy language.”

More casualty ILS activity

Activity in the casualty ILS space is picking up, amid increased demand for alternative capital solutions from primary casualty insurers and growing investor interest in the casualty ILS asset class, according to the report.

“Specialist players, including Chubb, Arch Capital, AXIS Capital and RenaissanceRe, have for many years managed affiliated multiline reinsurance sidecar vehicles that have established a precedent for casualty ILS transactions,” Moody’s said.

“They have now been joined by a new wave of casualty ILS platforms, including ILS-focused InsurTech Ledger Investing, which completed a $250m syndicated secondary casualty ILS trade in August 20232. The following month, AXIS Capital and Stone Point Credit Adviser LLC launched the first sidecar to write casualty reinsurance business,” the report said.

Over recent years, many US and Bermuda-based (re)insurance companies have pulled back from natural cat coverage after several years of large losses and expanded into less volatile casualty lines, the report noted.

“Some market participants believe that casualty ILS could eventually overtake the property catastrophe ILS market, given the scale of the casualty liabilities on (re)insurers’ balance sheets.

At the same time, investor appetite for casualty ILS is growing because it offers diversification from catastrophe risk. According to the paper, there is also an opportunity for issuers to provide casualty ILS investors with more flexible options by splitting long-tailed casualty liabilities into tranches with specific time horizons.

The casualty ILS market is also subject to some constraints that could hinder its development, Moody’s noted, although we believe advances in technology and transparency improvements will mitigate them over time.

“Firstly, casualty risk is more closely correlated with financial markets and macroeconomic conditions than property catastrophe risk. For instance, mortgage insurance, which compensates banks in the event of a mortgage loan default, is more likely to incur claims when economic growth slows,” the report said.

“Secondly, casualty risk modelling lacks a common framework and is less familiar to investors, in contrast to the well-established modeling techniques for property catastrophe risk.

Finally, uncertainty regarding the long term impact of regulatory changes and “social inflation” – rising claims because of increased litigation costs – make it more difficult to accurately estimate losses.”

No comments yet