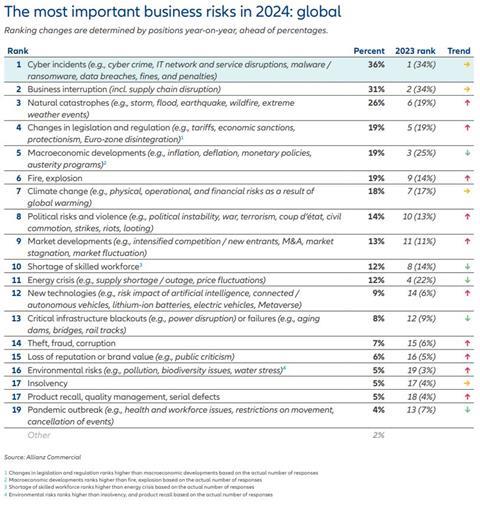

Data breaches, attacks on critical infrastructure or physical assets and increased ransomware attacks drive cyber concerns, in the German insurer’s annual paper on the global risk landscape.

Cyber incidents are the biggest worry for companies globally in 2024, according to the Allianz Risk Barometer.

The insurer noted that waves of ransomware attacks, as well as the threats of data breaches, and IT disruptions, collectively represent risk number one for commercial insurance buyers.

Business interruption, closely interlinked with aspects of cyber disruption, ranked second in the German insurer’s chart, based on the insights of more than 3,000 risk management professionals.

Next in the roster is natural catastrophe risk, rising from sixth last year to third this time. Fire and explosion concerns were up from ninth to sixth, while political risks and political violence were the other big risers, up from 10th to the number eight spot.

“The top risks and major risers in this year’s Allianz Risk Barometer reflect the big issues facing companies around the world right now – digitalization, climate change and an uncertain geopolitical environment,” said Allianz commercial CEO Petros Papanikolaou.

Climate change was a “non-mover”, staying seventh ranked, globally, from last year to this year, but was among the top three business risks in Brazil, Greece, Italy, Turkey, and Mexico.

“Many of these risks are already hitting home, with extreme weather, ransomware attacks and regional conflicts expected to test the resilience of supply chains and business models further in 2024. Brokers and customers of insurance companies should be aware and adjust their insurance covers accordingly,” Papanikolaou said.

The global risk chart is at the end of this article.

Cyber trends in 2024

Cyber incidents (36%) ranked as the most important risk globally for the third year in a row – for the first time by a clear margin (5% points). It is the top peril in 17 countries, including Australia, France, Germany, India, Japan, the UK and the US.

A data breach is seen as the most concerning cyber threat for Allianz Risk Barometer respondents (59%) followed by attacks on critical infrastructure and physical assets (53%). The recent increase in ransomware attacks – 2023 saw a worrying resurgence in activity, with insurance claims activity up by more than 50% compared with 2022 – ranks third (53%).

“Cyber criminals are exploring ways to use new technologies such as generative artificial intelligence (AI) to automate and accelerate attacks, creating more effective malware and phishing,” said Scott Sayce, global head of cyber for Allianz’s commercial insurance arm.

The growing number of incidents caused by poor cyber security, in mobile devices in particular, a shortage of millions of cyber security professionals, and the threat facing smaller companies because of their reliance on IT outsourcing are also expected to drive cyber activity in 2024.”

UK risk focus

Macroeconomic concerns tumbled in UK, the insurer noted, as businesses show much greater concern with shortages of skilled workers, new technologies and political risks than their global peers.

In the UK there was a 10% downward swing in concerns about cyber risk (from 40% to 36%) as opposed to a global rise in concern about this risk (from 34% to 36%).

In a sign that the risk environment may be diversifying in the UK, the insurer noted a sharp drop in macroeconomic concerns, which fell by almost half from 34% to 18% between 2023 and 2024.

Instead other risks rose to the fore in the UK, where shortage of skilled workers was the fourth most significant risk for all businesses (proving a challenge for 21% of firms).

Also uniquely important in the UK were political risks (a concern for 19% of respondents in the UK as against 14% globally) and the risks posed by new technologies (which were significant for 18% of UK respondents as opposed to just 9% globally).

“The UK takes a different view on major risks to its global peers. While cyber is still the leading risk, concern about this and also about macroeconomic conditions have fallen over the last year,” said Nadia Côté, Allianz commercial managing director for the UK.

“Instead an aligned group of other issues have risen to the forefront for business leaders. Shortage of skilled workers and the rising risk from new technologies such as AI bring together an increasing concern about a changing workplace and risks that group together in the D&O arena,” she said.

“Meanwhile, while the UK economy has stabilized, the political environment, coming into a UK election year with a change of government widely expected, is unsurprisingly a worry for business leaders,” Côté added.

No comments yet