Willis Towers Watson Energy Market Review concluded pricing is likely to remain firm, but renewables represent risk management uncertainty, offshore construction is unprofitable, and upstream energy’s profitability could be broken by a single mid-sized loss event.

WTW has released its annual Energy Market Review, providing a snapshot of a market enjoying tightened discipline for prices and terms, but that energy profitability is not blanket, and still fragile and vulnerable to losses in some key areas.

The broker gave the following view on average rating increases in the energy segment.

- Major exploration and production (E&P) programmes: +5%

- Offshore contractors: +5% to +7.5%

- Small to medium E&P programmes: +7.5% to +12.5%

- Midstream: +15% to +20%

- Offshore Construction (Platforms): +15% to +25%

- Onshore Contractors: +20% to +30%

- Offshore Construction (subsea): +30% to +50%

- Loss-affected business: exponential.

The emerging technologies behind energy companies’ transition to renewables, driven by climate risk pressure, is one area of concern highlighted by WTW’s 2023 report.

Many technologies expected to be foundations of energy transition “are simply not ready”, the report warned.

“The many proposed technologies have not been demonstrated at commercial scale, and a large proportion do not yet resemble industrial technologies at all. The result is that the job of scaling up and commercialising these technologies is, in many cases, in the hands of ‘first timers’,” said the WTW Energy Market Review 2023.

Upstream fragility

There is “continuing polarisation” of the upstream business, WTW said, with the choicest offshore operating programmes attracting much greater interest than lower value, onshore based drilling and midstream operations, according to the broker’s report.

Large areas of the energy portfolio remain unprofitable, WTW warned.

Rising operating costs driven by inflation, the rising cost of reinsurance, plus a number of upstream losses (see chart below), are contributing to the fragility of much of the segment’s profitability.

Reinsurance treaty costs alone are generally between 30-50% of upstream insurers’ overall costs, according to the report.

Upstream insurers have been faced with a stark choice, WTW warned: either increase retention levels significantly or have a substantial rise imposed on treaty reinsurance costs.

“Most have had no option but to elect the former, or a combination of the two,” said the report.

Upstream premium sits at approximately $1.5bn, the broker’s paper noted.

“Readers will appreciate that it would only take a medium sized loss, let alone a major loss along the lines of the Deepwater Horizon, Enchova or Piper Alpha tragedies, to obliterate the entire upstream global premium income pool, so perhaps it is not surprising that this is increasing the market’s apprehension as more losses are reported,” the WTW added.

Offshore construction “inherently unprofitable”

Offshore property was described as a “well-regarded sub-sector” and returned to profitability in 2021. Onshore property, by comparison, including midstream assets such as pipelines and LNG plants, has been unprofitable in recent years, said the broker.

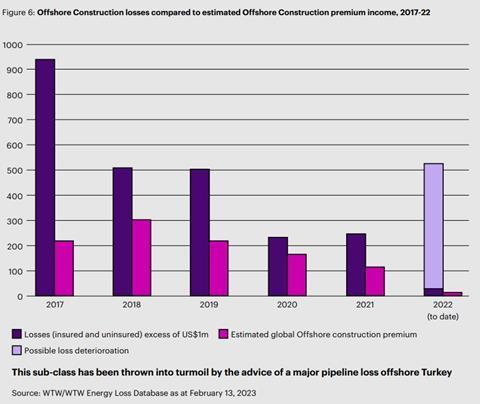

Offshore construction was singled out for concern. It has been beset by “continued unprofitability”, WTW said, with loss development likely to continue to far outweigh premium income.

WTW said that it was aware of at least one major offshore construction loss in the Black Sea, which it understood “could be as high as US$400m”.

This developing loss event, plus two other “sizeable” well control incidents in North America, are likely to further deteriorate the offshore construction loss ledger for 2022.

“If the Black Sea loss recently reported to the market is factored into the 2022 figures already on our database (although this loss may fall into a prior year of account), it clearly indicates that this sub-sector remains inherently unprofitable — especially as the quantum of the loss falls within Upstream insurers’ retention levels,” WTW said.

“Smaller projects will also become increasingly difficult to place due to the lack of premium income. However, not all Upstream insurers will be affected by this; many of them essentially do not write Offshore Construction and their involvement is often limited to small lines only,” the report added.

No comments yet