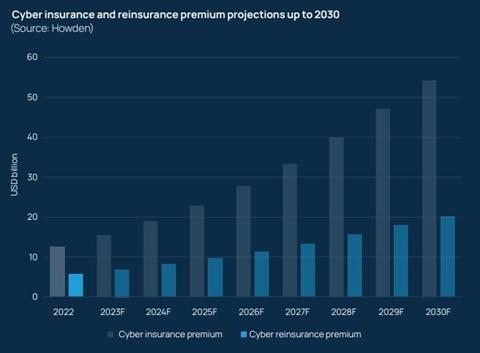

Some 45% of cyber premium gets ceded to reinsurers, cyber reinsurance premium is currently about $6bn, but the cyber reinsurance market will need to more than triple in size by the end of this decade to meet demand, according to Howden.

Howden has released its third cyber report, ‘Coming of Age’, with some bold claims about the potential growth awaiting the cyber insurance market.

The Coming of Age report predicts that the size of the cyber market could reach $50bn by 2030.

Howden’s study finds that the foundations are in place for the cyber market to scale up, but the realisation of this potential is tied to three key factors.

Growth hangs on these three challenges: distribution and penetrating new markets (particularly SMEs); addressing systemic risk tail-risks; and attracting additional capital, the broker said.

“If these challenges can be navigated successfully, the cyber market is on the cusp of potentially transformational growth,” the broker said.

Howden said it backs efforts to get ahead of the cyber warfare issue, given the highly volatile geopolitical climate, “by proactively providing clarity to clients and investors around the scope of cover”.

On the other hand, pricing increases that have driven the growth of the cyber insurance market in recent years are now receding, according to the broker.

War exclusions

The introduction of new war language has been “contentious”, the broker said, adding that clients are recognising the importance of proactively scoping out the parameters of cover for cyber warfare.

This, Howden said, is for their own benefit, minimising the potential for coverage disputes, as well as to insurers’ benefit, giving underwriters and investors “the confidence needed to commit to the market”, according to the broker.

Sarah Neild, head of UK cyber retail, said: “Getting this right is crucial for the sustainability of the cyber market.

“By providing a framework designed specifically for cyber’s unique risk profile, clients will be offered more certainty around the parameters of cover and what is insurable and what is not.”

The process of defining the limits of cover specific to cyber acts of war will help to fulfil the potential of this market, but only if the clauses are “fit for purpose and clients’ needs are met”, the broker said.

Neild added: “With one of the largest global reinsurers steadfast on the application of their war language, wider adoption seems inevitable, despite carriers’ disparate views on what adoption should look like. Increased uniformity on this topic would ultimately help the market secure relevance for the long term.”

Reinsurance Capital

Cyber reinsurance premiums are currently in the range of $6bn, and approximately 45% of primary market cyber insurance premium is ceded to reinsurers, according to the report.

The direct market’s use of reinsurance is the “single biggest differentiator” between cyber and any other class of business, Howden said. Broad capacity constraints and price corrections in the reinsurance market are presenting potential limitations, Howden suggested.

If the cyber market is to scale up to rival other major lines of business, cyber reinsurance supply will need to increase significantly in order to meet demand between now and 2030, the broker said.

The cyber reinsurance market will need to more than triple in size to fulfil growth expectations by the end of the decade, according to Howden. Such high levels of growth “would be ambitious during favourable market conditions, let alone when supply is as constrained as it is currently in the reinsurance market”, the report acknowledged.

Further innovative thinking around matching risk to capital is needed to realise the full potential of cyber re/insurance from here, the broker contended.

Growing consensus on risk definitions, alongside product innovation around systemic exposures in particular, are already attracting third-party investors, according to the market intermediary.

Maintaining focus and momentum in this area will be crucial to seeing alternative capacity becoming an integral part of the cyber market’s capital structure, the broker added.

“Ensuring that cyber insurance is relevant to clients of all sizes is paramount to improving access in new territories and across different sections of the economy,” said Shay Simkin, global head of cyber, Howden.

“Attracting capital is also crucial to this goal, a task which should not be underestimated given current macroeconomic challenges and capital constraints,” Simkin said.

“Howden remains committed to advocating for clients as the market adapts to what is a fluid and highly charged threat environment. As one of the biggest global insurance intermediaries in the world, we are conscious of our responsibility to inform the discussion in the interests of clients,” Simkin continued.

“Our report attempts to do just that. The analysis included extends to other critical areas such as supply chain risk, the fallout from the Ukraine war and read-across implications for future conflicts. By bringing important market trends to the fore, Howden is leading the discussion, enabling us to facilitate the most innovative client solutions and secure unrivalled access to capital providers.”

Ransomware rise

Market conditions started to stabilise last year as activity relented and more robust risk controls deterred or mitigated attacks, following a “major market correction”.

This correction came after a surge ransomware claims in 2020 and 2021, which led to the cost of cyber cover “more than doubling”, Howden said.

The broker noted that cyber rarely stands still, and developments in 2023 point to a nuanced marketplace.

Optimism around more favourable supply dynamics for insurance buyers – off the back of improved underwriting performance for insurers – is being tempered by resurgent ransomware activity, ongoing concerns about potential systemic losses and capital availability.

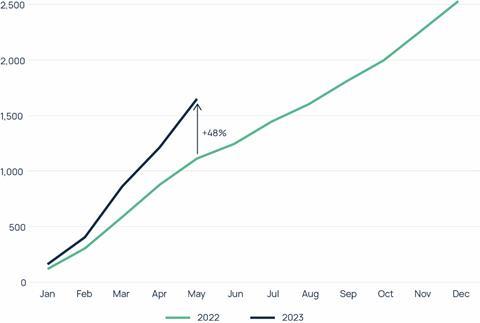

The first half of 2023 saw a significant rise in ransomware attacks, Howden reported (see second chart), but disclosures from a number of carriers in the first quarter of 2023 suggest this has not yet been accompanied by a corresponding rise in claims.

This points to the efficacy of risk controls in making companies more resilient and supporting a more stable cyber insurance market, the broker said. Conditions are now relenting, and buyers that have the correct risk controls in place are being rewarded with more favourable pricing and terms.

This puts the market on a sound footing for growth, but the report shows that more work need to be done if it is to meet the growing demands of clients worldwide. By overcoming potential limitations around systemic risk, penetration and capital, the cyber insurance market has an unparalleled opportunity to grow.

No comments yet