It’s one thing to lead an insurance federation during a period of small, incremental change. But the role is different when the regional industry is undergoing a broad and deepening transformation.

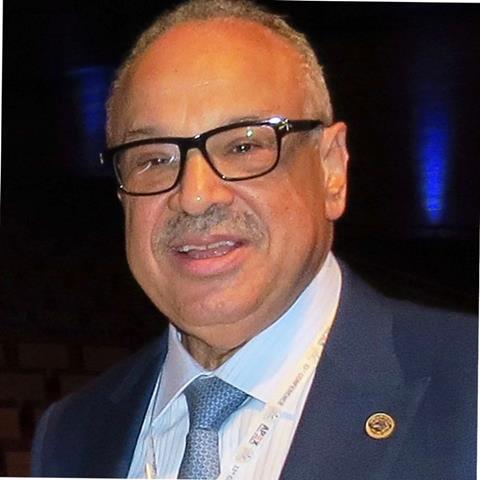

That is the situation that Chakib Abouzaid, secretary general of the General Arab Insurance Federation (GAIF) finds himself in at the beginning of 2024.

Abouzaid is preparing for GAIF’s 34th General Conference, to be held this year in Muscat, on 18-21 February, with GR attending as a media partner.

“The Arab insurance landscape”, he says, “is not similar to a mature market such as the European, US, Japanese, or Chinese markets. We’re in a different situation. There are countries doing relatively or extremely well like Saudi Arabia, the UAE, and Morocco because of the economic situation in the oil-producing countries. The states there have substantial income from petrol and oil and gas.”

This money, says Abouzaid, is being used by those governments to invest in infrastructure. This, he says, has been the story of the last two-to-three decades in the UAE, Dubai, and Abu Dhabi. Consequently, he says that this font of government spending has been the main driver for the insurance industry.

And there is more. “On top of that, he says, you have seen many changes in the market over the past ten years, especially around the introduction of compulsory medical insurance. That’s been the case in Saudi Arabia, the UAE, Qatar, Oman, and Kuwait. That’s added billions to the insurance industry.”

Even with all that in mind, Abouzaid stresses that penetration across the region is comparatively low to other markets. The amounts being talked about in gross written premiums (GWP), he says, is “peanuts” when put side by side.

“In 2022,” he says, “the GWP for the Arab region was around $50bn. That’s nothing compared to the $7tn worldwide. We are only something like 0.7%”

Abouzaid explains that there are different groups of countries. The more developed countries of the UAE, including its richest emirates of Dubai and Abu Dhabi, along with a handful of others, fall into one group. A second group, he says, are those countries that have some structure to the markets and good regulations, but where the GWP never exceed $3bn.

“Egypt is a good example of this,” he says. “GWP there were around $3bn three years ago but is now less than $2.5bn. That is because of the fluctuation in the local currency. So here, along with Tunisia and Algeria, the problem is not with the market or with the economic growth, but with the changes in the local currency. And that’s not allowing these countries to exceed $2bn or $3bn.”

Abouzaid went on about the grouping of countries. “And there’s the countries that lack the order of the GCC countries. Kuwait, Oman, Bahrain, and Qatar have less than $3bn in premiums. They’re small because of their population. But the obligatory medical and the motor insurance markets are growing, even if penetration remains low.”

And then there is another group—those facing geopolitical or internal strife. Here, Abouzaid namechecks the nations of Sudan, Syria, Iraq, Libya, Palestine, and Lebanon. These states, he says, used to be among the best in the region for penetration, which stood somewhere at three per cent until the 2019 financial crisis. Five years later, Abouzaid says it has become difficult to assess the exact volumes of premiums or the rate of penetration.

Moving forwards, the use of artificial intelligence (AI) has been a hot topic for debate in every industry. Abouzaid makes the case that the insurance sector is no different.

“We need to operate a kind of radical shift in how we do business,” he says. “We cannot leave it behind, and it’s something that we’ve already embraced. We can criticise AI, but it’s like the advent of computers in that we need to use it. The reinsurers are already using it for pricing, and it’s already being used in detecting claims fraud.”

Abouzaid discusses what will come next. “I think it’s going to be an important tool in underwriting, marketing, and processing claims, among other areas. And it’s something that is going to be very, very important,” he adds.

No comments yet