Severe convective storms drove global natural catastrophe insured losses, which reached $50bn across all perils, according to the Swiss Re Institute.

A series of severe convective storms struck the US and drove the majority of global insured natural catastrophe losses in the first six months of this year, Swiss Re has highlighted.

Worldwide, convective storms – bringing thunder, lightning, heavy rain, hail, strong winds and sudden temperature changes – caused some $35bn of insured losses worldwide in the first half of 2023.

The US thunderstorms represented $34bn of the losses and were well above ten-year average levels, Swiss Re said.

These storms collectively represented the highest ever insured losses at this point in the year, Swiss Re said.

Across perils, global insured losses from natural catastrophes reached some $50bn in the first six months of this year, revealed the study from the Swiss Re Institute.

Nat cat losses were at their second highest level since 2011, almost twice as high in a six-month period as the annual average of the last ten years ($18.4bn).

Last year saw another costly first six months: nat cat losses were at $48bn at the same point.

“With severe thunderstorms as the main driver for above-average insured losses in the first half of 2023, this secondary peril becomes one of the dominant global drivers of insured losses,” said Martin Bertogg, head of catastrophe perils at Swiss Re.

“The above‑average losses reaffirm a 5 – 7% annual growth trend in insured losses, driven by a warming climate but even more so, by rapidly growing economic values in urbanized settings, globally.

“The cyclone and flood events in New Zealand in the first quarter of 2023 are testimonies of the risk to today’s large urban centres, continuing patterns observed in 2021 in the Germany flooding, and in 2022 in Australia and South Africa,” Bertogg added.

“Secondary perils”

Ten events caused losses of at least $1bn each, compared to an annual average of six events for the previous ten years. The most affected state was Texas.

Swiss Re said the damage caused highlighted the increasing loss impacts of secondary perils for re/insurers – i.e. not just the hurricanes, typhoons and earthquakes that the industry has traditionally considered its primary perils.

New Zealand was hit by two severe weather events just two weeks apart in early 2023, highlighting the growing risk of weather-related perils hitting large urban centres.

In particular, the North Island of New Zealand was hit in quick succession in the first quarter with severe flooding in Auckland, the country’s largest city, and the remnants of Cyclone Gabrielle.

Both became the two costliest weather-related insured loss events in New Zealand since 1970, with combined insured losses estimated to be $2.3bn, Swiss Re said.

Climate change effects

Heavy rainfalls in northern Italy’s Emilia-Romagna region in mid-May led to extensive flooding and expected insured losses over $0.6bn, the costliest weather-related event in the country since 1970.

Estimated economic losses were $10bn. With 94% of losses being uninsured in Italy, the important role of insurance as a means to close the protection gap and help households strengthen their financial resilience against natural catastrophes becomes obvious.

Northern Italy has experienced drought conditions over the last two years. With the heavy precipitation, the ground rapidly became saturated, leading to increased run-off and flooding. The overall trend shows a significant increase in drought in southern Europe. However, changes in seasonality may lead to less frequent but more intense heavy rain events.

“The effects of climate change can already be seen in certain perils like heatwaves, droughts, floods and extreme precipitation,” said . Jérôme Jean Haegeli, Swiss Re’s group chief economist.

Since early July, the US, north-western China and southern Europe have become heatwave hotspots this year.

In southern Europe, dry weather conditions and strong winds aggravated wildfires (most likely induced by human activity) on many Greek islands, as well as in Italy and Algeria, although it is still too early to estimate the damages regarding both the economic and insured losses.

“Besides the impact of climate change, land use planning in more exposed coastal and riverine areas, and urban sprawl into the wilderness, generate a hard-to-revert combination of high value exposure in higher risk environments,” Haegeli said.

“Protective measures need to be taken for insurance products to remain economical for such properties at high risk. It is high time to invest in more climate adaption,” he added.

Turkey earthquake

Earthquakes still cause some of the most severe humanitarian and financial consequences, Swiss Re observed.

The biggest economic loss disaster of the first six months was the earthquake that shattered parts of Turkey and Syria in February 2023.

The insured loss was the highest for a single nat cat event in the first six months, standing at $5.3bn, according to Swiss Re’s estimate.

Whereas the preliminary economic losses from the quake are at $34bn, according to a World Bank estimate, highlighting the size of the protection gap.

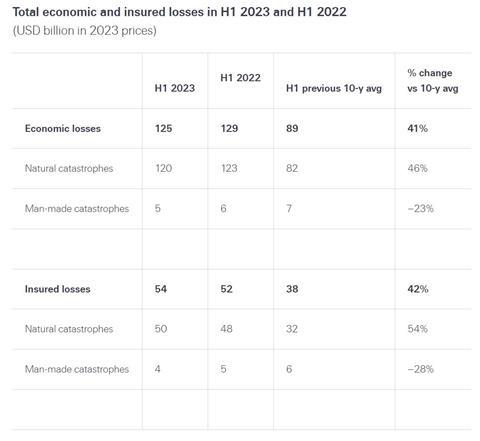

In the first half of 2023, the overall economic losses from natural catastrophes amounted to $120bn, compared to $123bn the prior-year period, 46% above the ten-year average, Swiss Re added.

No comments yet