The devastating Maui wildfire is likely ranked among the most costly insured catastrophes in Hawaii’s history.

Rating agency Moody’s has provided a report on the wildfires that have caused a tragic loss of life and destroyed most of the Lahaina community in western Maui, Hawaii.

Given the damage assessment and Lahaina’s relatively high $1.5m average single-family home value, Moody’s estimates insured losses will be at least $1bn.

The Maui wildfire is likely among the most costly catastrophes in the US state’s history, according to Moody’s.

Hurricane Iniki caused $1.6bn in insured losses in 1992, which would be about $3.5bn in 2023 dollars, according to the Insurance Information Institute.

Homeowners & commercial property

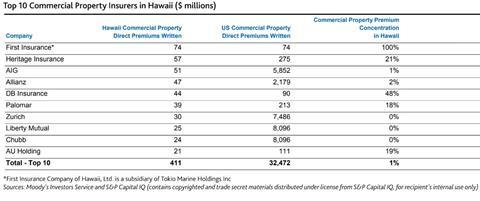

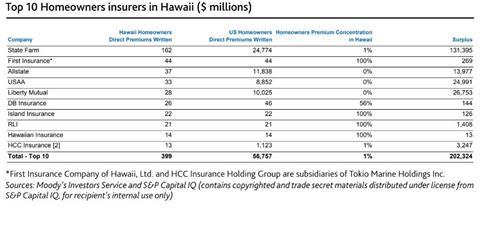

Property and casualty (P&C) insurers with significant homeowners and commercial property market share in Lahaina will be those most affected, Moody’s said, although it will take weeks or months to determine the magnitude of the insured damage.

Although the proximate causes of the fires are still unknown, they spread quickly amid dry conditions and heavy winds, partly from Hurricane Dora’s passage several hundred miles south of Hawaii.

The Lahaina wildfire also spread rapidly because most of the area’s buildings were close together and made of combustible material such as wood, the report noted.

Primary insurers, such as State Farm Mutual Automobile, Tokio Marine and Allstate have exposure in Hawaii, but Moody’s expects large carriers will readily absorb the losses given that business in Hawaii is a small fraction of their overall insured portfolios.

“These firms have considerable resources to withstand catastrophe events given their careful monitoring of exposures, geographic diversification, high quality reinsurance protection and strong capital bases,” Moody’s said.

“Some reinsurers could incur a share of the wildfire losses through catastrophe policies as well as quota share and per risk policies,” the rating agency added.

See the charts from the report at the bottom of this article for the list of P&C insurers - commercial and homeowners - likely to be most affected.

Wildfire trend

The average area burned by wildfires each year in Hawaii has increased about 400% over the past century, according to the Hawaii Wildfire Management Organization, as climate change increased average temperatures and decreased average rainfall, Moody’s said.

The prevalence of non-native grasses such as guinea grass has increased significantly, particularly on the leeward sides of the Islands.

These grasses grow quickly during rains but create a large mass of dry vegetation when conditions dry. According to US Drought Monitor, the entire island of Maui had “abnormally dry” or drought conditions as of 8 August.

When Hurricane Lane struck in 2018, a wildfire destroyed 22 homes and burned 2,800 acres in Maui. There were also active wildfire seasons in Hawaii in 2019 and 2021.

“Homeowners and commercial property insurers will likely reassess their exposures, pricing and reinsurance arrangements related to wildfires in Hawaii,” Moody’s said.

High construction costs

Construction costs are typically high in Hawaii because most building materials need to be brought to the islands, noted the ratings firm. Construction materials and labour costs increased significantly during the pandemic and the increase is driving higher property replacement costs, which feeds through to higher homeowners and commercial property claims.

Maui may need construction workers from other Hawaiian Islands or from the US mainland, and construction workers may face their own housing shortages. The increase in demand for construction labour and materials following the wildfires is likely to lead to higher insured losses, Moody’s warned.

Hawaiian homeowners insurers are also likely to be adversely affected by additional living expense claims, which are typically capped at 30% of a dwelling’s value and are paid only if the property is damaged or if has been subject to mandatory evacuation, Moody’s suggested.

“Construction delays from a demand surge could exacerbate living expense claims. In addition, homeowners policies typically cover the contents of a home at about 50% of a home’s value. Given high construction inflation in recent years, some insured homeowners may find their coverage is insufficient to fully cover rebuilding costs,” Moody’s said.

Aside from property damage, commercial lines claims will likely include business interruption losses. Direct business interruption is triggered only if the loss was caused by damage to business premises from a covered peril,” the ratings firm added.

No comments yet