1/1 reinsurance renewals showed moderate price increases across most lines due to balanced supply and demand, according to ratings firm Moody’s.

January renewals were largely in line with expectations from Moody’s Reinsurance Buyers’ Survey, the rating agency has reported.

Most respondents expected 2024 reinsurance price increases in the mid-single digit range for casualty and around 7.5% for property, the survey had noted.

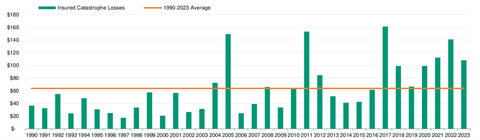

Global insured catastrophe losses in 2023 were above the long-term average for seventh straight year, Moody’s observed in its report.

The report made some key observations, as well as the charts below:

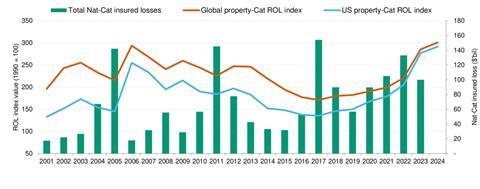

- The upward reinsurance price momentum is slowing as capacity increases. The mismatch between supply and demand for property catastrophe reinsurance that led to sharp pricing increases last year has largely abated.

- Reinsurance pricing is expected to remain firm in April and July, the key renewal dates for Japanese and US reinsurance contracts, respectively. However, pricing has moved high enough to attract additional reinsurance capital to the market, so sharp price increases are not expected in the absence of large catastrophe losses.

- Global insured catastrophe losses in 2023 were approximately $108bn, well above the historical long-term average of $64bn (1990-2023). The high level of catastrophe loss activity has significantly impacted reinsurers’ profitability, requiring firms to continue to ratchet up the price of risk transfer capacity.

- Additionally, reinsurers have raised attachment points, tightened terms and conditions and restricted aggregate coverages in an effort to reduce volatility and improve returns on capital. This strategy to mitigate the impact of increased catastrophe frequency and severity paid off during 2023, with most reinsurers expected to report returns on equity in the 15% to 20% range.

No comments yet