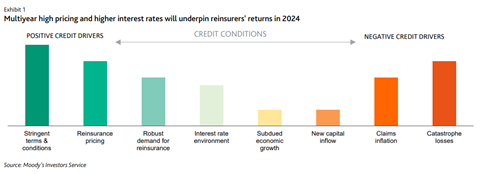

Moody’s expects continued strong demand for reinsurance and higher investment yields, to drive attractive RoEs for the sector in 2024, assuming no large catastrophe events.

Demand for reinsurance will remain robust in 2024 despite subdued economic growth, according to Moody’s. This will support strong sector earnings, absent major natural catastrophes, said a new report from the rating agency.

Reinsurance prices will likely peak this year as competition intensifies, Moody’s said, expecting claims costs will continue to rise, with higher wages and increased litigation outweighing lower consumer price inflation.

As prices peak, more frequent and severe natural catastrophes are adding to uncertainty around reinsurers’ ability to price and manage these exposures, the rating agency said.

Despite uncertainties, Moody’s expects underlying performance for reinsurers to improve further in 2024.

This is because reinsurance prices at multi-decade highs, stricter policy terms and conditions, lower inflation and flat retrocession costs, which will bolster reinsurers’ underwriting margins in 2024, assuming no major catastrophes, Moody’s said.

Stronger investment yields following recent interest rate rises should also lift reinsurers’ investment income, the rating agency said.

Reinsurance demand remains robust, Moody’s emphasised. Property and casualty (P&C) reinsurance premiums will continue to grow as higher insured values and increased risk perception after several consecutive years of above average catastrophe losses support demand.

Meanwhile, stronger protection sales in the Asia-Pacific region and surging demand for longevity reinsurance will support growth in the life reinsurance market.

The 1 January 2024 policy renewals suggest reinsurers have scope to push through further price increases, Moody’s said, leading to peak pricing this year.

However, the sector’s improved returns are encouraging some groups to take on more risk and could also attract more alternative capital inflows. This will likely make supply-demand dynamics less favourable in 2025. While prices are therefore likely to reach their high point this year, reinsurers’ earnings should remain strong provided they avoid relaxing their policy terms and conditions.

Inflation eases, but claims costs keep rising, according to Moody’s. Extreme weather is becoming more frequent, and the use of litigation in claims settlements, i.e. social inflation, is amplifying insured losses.

Total claims costs will therefore continue to rise, the report suggested, despite lower consumer price inflation. Persistent claims increases could prompt insurers to raise reserves on existing claims and strengthen incurred but not reported provisions.

High catastrophe losses complicate the pricing and risk management picture, Moody’s noted.

Convective storm losses reached an all-time high of $60bn in 2023, the hottest year on record, with a Swiss Re estimate that the catastrophe loss burden to grow by 5-7% annually. The complexity of climate change also makes it harder for reinsurers to quantify, price and manage catastrophe risk, Moody’s added.

No comments yet