How satellite radar is revolutionising hurricane insurance response, by ICEYE’s Rupert Bidwell

In the aftermath of a major hurricane, time is critical. Yet for decades, insurers have had to wait for skies to clear, aircraft to fly over impacted areas, models to be updated, and fragmented reports from ground sources.

In an environment where speed, accuracy, and customer confidence are critical, such delays and data shortfalls are extremely costly. It slows down claims processing, increases operational expenses, and leaves policyholders in a state of uncertainty during extremely challenging situations.

The need for a better approach is becoming more urgent as hurricanes increase in scale and frequency and become less predictable, a situation further exacerbated by increasing restrictions on the scope of hurricane-related data available from national bodies.

However, advances in satellite technology – and particularly synthetic aperture radar (SAR) – are giving insurers a powerful new capability: the ability not only to monitor storm tracks in near real time, but also now conduct initial property damage assessments at the neighbourhood level.

These systems provide insurers with high-resolution imagery and observation-based data even during adverse weather, enabling them to move quickly, allocate resources more effectively, and make informed decisions based on what’s happening on the ground.

Hurricanes are changing

Recent decades have seen significant changes in hurricane activity, with research showing that the number of Category 3 or stronger hurricanes in the Atlantic has doubled since 1980.

Also, storms are intensifying more rapidly, often just before landfall, making accurate forecasting more difficult.

This rapid intensification is compounded by other shifts. Hurricanes today are moving more slowly, extending their destructive impact and increasing rainfall, while warmer ocean temperatures are fuelling storms with more moisture. Additionally, rising sea levels are exacerbating storm surge risks, turning coastal flooding into a more frequent and destructive peril.

These factors are increasing not just the severity of losses, but also the uncertainty insurers face. The traditional tools used to manage post-hurricane response are simply not keeping up.

Data gaps in traditional response methods

Historically, insurers have relied on aerial imagery, probabilistic models, and on-the-ground assessments to evaluate hurricane damage. However, each method has serious limitations. Aerial flyovers are frequently delayed by weather conditions and logistical constraints, often producing imagery that only covers selected areas based on pre-storm assumptions, while entire neighbourhoods or rural zones may be missed.

Probabilistic models, while useful for estimating portfolio-level impacts, are built on historical averages and assumptions. Models struggle to capture the complexity, real-time behaviour of hurricanes, and are not effective for making operational decisions about deploying adjusters or prioritising claims.

The information that insurers do receive post-landfall is typically limited in scope and resolution. There is often limited data on areas hardest hit or how damage breaks down between wind and flood. This leads to guesswork in resource allocation and delays in triage. In many cases, accurate damage estimates aren’t available until several days after the event.

A new layer of intelligence: SAR satellite data

Now, SAR technology is addressing long-standing blind spots in hurricane response. Unlike optical or aerial imagery, SAR uses radar to detect surface-level changes, allowing satellites to capture detailed images through cloud cover, rain, and darkness. This means insurers can receive observational data on the storm footprint even while weather conditions remain poor and traditional assets are grounded.

Further, satellite constellations enable data capture along the entire hurricane track often spanning tens of thousands of square kilometres. With Hurricane Milton, ICEYE monitored the storm from its formation, acquiring over 100 SAR satellite images of impacted areas through thick storm clouds and at night, capturing data from the landfall location in Siesta Key, following through to Daytona Beach.

The ability to assess building damage begins in advance of any storm. SAR satellite images expose coastlines and high-population areas frequently in advance of hurricane season. When a storm is forecasted, satellites capture detailed current images of expected impact zones both before and after landfall. For the North American region, ICEYE has imaged over 1.2M km2 of exposed coastline from South Texas, covering all of Florida and up the coastline to Maine, at least 150 miles inland.

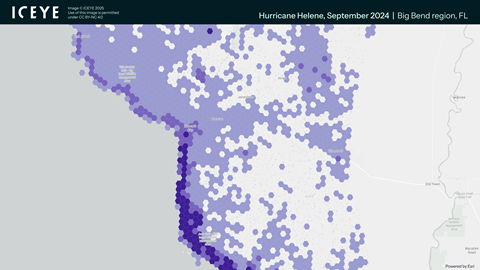

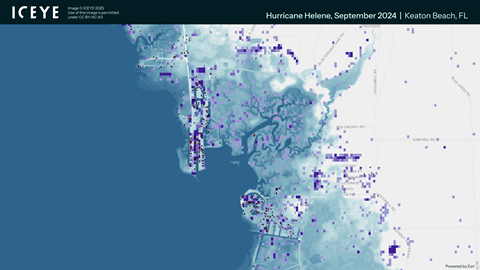

By comparing pre-event and post-event data, the system can detect structural changes, shifts in land cover, and the extent and depth of flooding, producing detailed data layers that reflect both wind and water impacts. During Hurricane Helene, which caused extensive wind and flood damage, ICEYE data showed over 150,000 buildings damaged and over 13,000 inundated by over 5 feet of water.

Within 12-24 hours of landfall, insurers can access high-resolution raster and vector data that show where damage has occurred, how severe it is, and what perils are impactful. These insights are updated daily, allowing companies to refine their event understanding as more information becomes available.

Turning data into action

With SAR-based satellite imagery, insurers are no longer waiting for clarity before acting. They can begin triaging claims, allocating adjusters, and planning their response ahead of the storm making landfall and adapting that strategy dynamically as the event develops.

For instance, when building-level damage is identified early, insurers can proactively contact policyholders with significant losses, often before claims are even filed. Teams can be deployed to the hardest-hit areas based on observed, not assumed, impact. This improves customer satisfaction, reduces fraud, and ensures that field resources are used where they’re needed most.

In cases involving wind and flood damage, SAR data helps distinguish loss types – critical for managing coverage questions, deductibles, and reinsurance. Claims that require specialised handling can be flagged early, and adjusters with appropriate expertise can be matched to the job.

This situational awareness also supports more accurate reserving. Instead of relying on model projections or manual reports, insurers can begin estimating losses with real observational data, improving financial planning and communication with stakeholders, including their reinsurers.

Bridging the gap between ground and orbit

One of the most valuable aspects of SAR data is its scalability. The resolution is granular enough to support neighbourhood-level assessments, yet flexible enough to provide a full picture of hurricane impact across entire cities, states, or regions. This makes the technology useful for everything from localised claim decisions to portfolio-wide exposure analysis.

Importantly, this is not a replacement for human adjusters. Rather, SAR imagery acts as an intelligence layer that enhances traditional workflows. It ensures that adjusters are sent to the right places with the right tools. It reduces redundant site visits and accelerates decisions on emergency assistance, materials, and accommodations.

Insurers can also use SAR data to distinguish between multiple weather events. When two storms hit the same area in quick succession, pre- and post-event comparisons allow analysts to isolate the damage caused by each storm, improving accuracy in claims attribution and reinsurance reporting.

A strategic advantage in a changing climate

As the frequency and intensity of hurricanes continue to rise, the ability to respond quickly and confidently is becoming a strategic differentiator. SAR satellite imagery offers a fundamental advantage: the power to base decisions on observed reality, not assumptions.

Insurers adopting this technology gain a critical head start in identifying losses, reaching customers, and managing resources. The traditional waiting period – once considered inevitable after major storms – is no longer necessary. Instead, insurers can move from reactive to proactive, from uncertain to informed, and from delayed to immediate.

By Rupert Bidwell, vice president, insurance solutions, ICEYE

To download the full Monte Carlo RVS 2025 annual issue of GR, click here.

No comments yet