Reinsurance buyers experienced accelerating price softening at the 1 January 2026 renewals, but casualty produced more nuanced outcomes, the reinsurance broker revealed

Reinsurance pricing dropped further at 1 January renewals, after reinsurers deployed growing capital after another year of strong returns, according to Guy Carpenter’s renewals briefing.

Expanded capacity across the sector resulted in double-digit risk-adjusted rate reductions across several major lines, particularly in property catastrophe, according to the reinsurance broker.

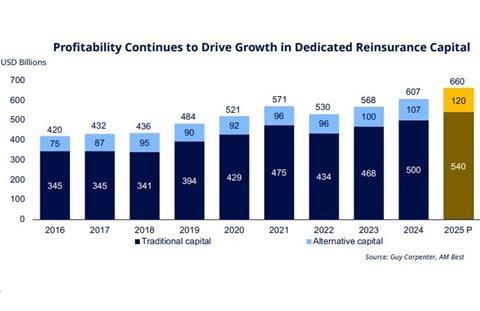

Dedicated reinsurance capital increased by an estimated 9% during 2025, while reinsurers’ average return on equity was estimated at around 17%.

Global insured catastrophe losses were estimated at $121bn for 2025, around 18% below the five-year inflation-adjusted average.

Reinsurers also retained a smaller share of those losses, Guy Carpenter emphasised, with their contribution falling to 11% compared with roughly 20% prior to the market shift in 2023.

That combination of excess capital, profitable underwriting and sustained property pricing encouraged a renewed appetite for growth.

For non-loss-impacted property catastrophe programmes, cedants secured double-digit risk-adjusted rate reductions at renewal.

Buyers also focused on improving risk sharing through structures such as aggregate covers and catastrophe quota shares.

Investor appetite for insurance-linked securities further supported softer conditions.

Catastrophe bond issuance reached new highs during 2025, with total notional outstanding exceeding $58bn and 15 first-time sponsors entering the market.

Casualty renewals produced more nuanced outcomes.

Results varied by region, structure and historical performance, although programmes were generally stable, with improvements for proportional structures backed by disciplined portfolios.

Sidecars continued to grow in importance, particularly for longer-tail casualty risks.

The cyber reinsurance market also continued to evolve, moving away from broad quota share structures towards more targeted event-based and hybrid treaty designs.

Reinsurance is increasingly being used as a strategic growth tool rather than purely a volatility hedge, the reinsurance broker suggested.

President and CEO of Guy Carpenter Dean Klisura said: “Despite global trade tensions and increased regulatory scrutiny, reinsurers have grown capital due largely to strong retained earnings.

“This has allowed clients to benefit from lower prices and a wider range of innovative solutions to meet their rapidly evolving needs,” Klisura added.

No comments yet