Property cat pricing was down 15%, while London market casualty placements also dipped amid increased supply, the reinsurance broker said

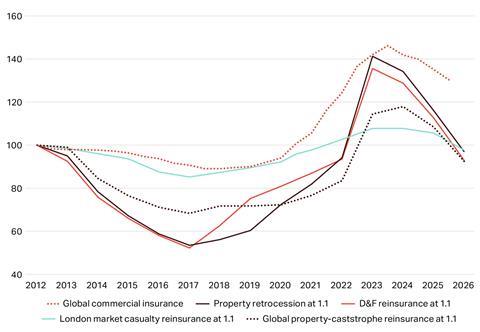

Risk-adjusted price reductions at 1 January 2026 have brought reinsurance pricing back towards levels last seen around four years ago, according to a renewals report from Howden.

Howden’s report, titled “Re-balancing”, points to widespread softening across most major lines, supported by strong balance sheets, retained earnings and intense competition for growth.

Global property catastrophe rates fell by an average of 14.7% on a risk-adjusted basis.

Property retrocession pricing declined by around 16.5%.

Direct and facultative reinsurance saw reductions of roughly 15 to 20%.

London market casualty programmes achieved risk-adjusted reductions of between 5-10%, according to the broker.

Strong underwriting performance across the market in 2025 meant insurer and reinsurer returns exceeded costs of capital, even after major events such as the Los Angeles wildfires.

That profitability encouraged reinsurers to deploy capacity aggressively at the 1 January renewal.

With core programmes placed for less spend than expected, some cedants chose to purchase supplementary coverage to manage retentions and volatility.

Others plan to redeploy savings to buy additional protection during the first half of 2026.

In property catastrophe, elevated loss activity failed to halt the softening trend.

Programmes in the US and Europe typically achieved risk-adjusted reductions of between 10 and 20%, with the sharpest falls recorded in France, Italy, Switzerland and the UK.

Asia-Pacific renewals were similarly competitive, with loss-free non-proportional programmes benefiting from double-digit reductions.

Retrocession capacity was more than sufficient to meet demand, supported by retained earnings, new market entrants and continued ILS inflows.

Terms and conditions moved more modestly, with reinsurers largely resisting pressure to broaden coverage for non-natural perils such as civil unrest and terrorism.

Casualty renewals were more stable, particularly in the US, where long-tail loss development and reserving concerns continued to influence outcomes.

International casualty programmes experienced modest softening, although US exposures remained more challenging.

Specialty lines generally performed well, allowing buyers in areas such as credit and political risk, cyber, marine and energy, and political violence to benefit from favourable conditions.

Aviation was the main exception, with slight firming following losses during 2025.

“Healthy supply dynamics and increased competition, particularly in property-catastrophe, created a genuine re-balancing of the market at this renewal,” said Tim Ronda, CEO of Howden Re.

“The best outcomes were achieved through working with markets and capital providers to execute holistic, data-led programme solutions that balanced pricing, structure and risk transfer across portfolios,” Ronda added.

No comments yet