A new modelling analysis of a Lloyd’s extreme disaster scenario has revealed potential insured losses from follow-on civil unrest could exceed $20bn, with mid-sized cities and overlooked exposures posing unexpected threats to re/insurers.

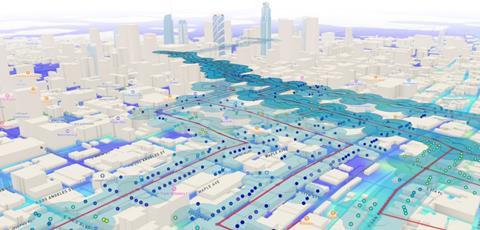

The study, published by Synthetik Insurance Technologies, uses its srccQuantum platform to model Strike, Riot and Civil Commotion (SRCC) events triggered by a major earthquake along the Cascadia Subduction Zone.

The scenario—developed by the Lloyd’s re/insurance market—considers both environmental and immigration-related catalysts for multi-wave unrest across North America.

Synthetik is itself a graduate of the Lloyd’s Lab, which is the incubator set up by Lloyd’s to partner recent startup insurance technology firms with insurance market players.

The full sequence of unrest outlined in the Lloyd’s “Extreme Disaster Scenario” spans approximately five months, with all SRCC activity occurring within a single 12-month policy period.

According to the white paper, cumulative losses from organised demonstrations and dispersed civil unrest could range from $4.1bn under low-intensity conditions to over $20.8bn in very high-intensity events.

“The simulations highlighted substantial potential losses ranging from $1.4bn under low-intensity conditions to $9.5bn in very high-intensity scenarios” for large-scale demonstrations in major North American cities including New York, San Francisco and Washington DC.

But the greater threat lay in regional spillover, the study found: “Dispersed civil unrest in smaller towns and cities showed even greater cumulative losses, from $2.7bn at low intensity to over $11.2bn at very high intensity,” with nearly 100 West Coast towns and cities individually modelled.

The findings underscore growing concern around SRCC as a key risk aggregation challenge. “SRCC has transitioned from a secondary concern to a central focus within not only the political violence market but also for broader all-risk property policies,” said Tim Brewer, chief operating officer at Synthetik.

“These shifts demanded a reassessment of risk modeling practices within the Lloyd’s insurance market. Using our next-gen SRCC platform… we have evaluated this shift in potential loss patterns and exposures under realistic conditions across North American urban centres.”

Synthetik’s modelling emphasises contagion-style spread of unrest, not solely by geography but through “economically and symbolically significant pathways,” warning of the inadequacy of traditional risk aggregation methods.

The report also exposes “latent exposure” in second-tier cities, where retail and logistics hubs create overlooked vulnerabilities. This pattern of “silent accumulation risk” poses a particular challenge for portfolio diversification and clash modelling.

Josh Hatfield, chief product officer at Synthetik, said the results made a strong case for adopting new tools to manage civil unrest exposures: “This report underscores the critical importance of adopting advanced modeling practices to effectively anticipate and mitigate SRCC exposures, enhancing the insurance market’s overall resilience.

“The srccQuantum platform provides insurers with a robust, predictive analytical tool to address these complex risks. It facilitates more accurate pricing, improved reinsurance structuring and enhanced portfolio management strategies.”

Here’s a link to the full white paper.

No comments yet