Growth in Europe looks steady but remains fragile in 2026–27, according to Swiss Re’s Sigma briefing held in London today, shaped by fiscal dominance, re-industrialisation, sticky inflation and elevated catastrophe losses

Global economic growth looks stable on the surface, but Swiss Re says the environment ahead is defined by uncertainty, regime shifts and some rising downside risks.

Swiss Re held its “Global Economic and Insurance Market Outlook 2026/27” media briefing in London today.

Jerome Haegeli, group chief economist and head of the Swiss Re Institute, said the 2026–27 economic backdrop appears like a straight road.

However, this superficial view is in reality based on “shifting sands” below the surface.

“It’s going to be a fiscal policy driven economy going forward,” Haegeli (pictured) said.

He noted that the UK represents an exception, as “all the rest of the world continues to run huge fiscal deficits”.

This situation is likely to keep inflation higher for longer, Haegeli warned.

He also predicted that inflation at 2% would now be “the floor and not the ceiling”, with global inflation likely closer to 3% into mid-2026.

Growth, meanwhile, will be capped. “We are more likely seeing actually 2% being rather the ceiling than the floor,” he said.

He added that the greatest risk was not geopolitics but “the risk of complacency”, given financial markets were still pricing perfection despite economic imbalances.

Swiss Re expects global premium growth of around 2.2% in 2026 and 2027.

Swiss Re’s chief economist said non-life growth would normalise, while the savings sector would benefit from higher rates.

Returns on equity should remain in “double digit territory”, above insurers’ cost of capital, he emphasised.

Haegeli highlighted several structural shifts shaping the outlook: a K-shaped economy masking inequality; the rise of industrial policy and re-industrialisation; the threat of financial fragmentation; and a shift to structurally higher inflation.

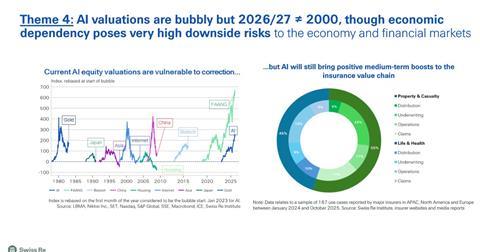

He also highlighted the role of artificial intelligence (AI) as both an opportunity for underwriting, distribution and claims, and a potential source of volatility.

On the question of whether or not AI firms represent a bubble, a slide suggested their stock valuations were elevated, but that the AI boom was still a benefit to insurers (see image at the bottom of this article).

Turning to the UK, Charlotte Mueller, European chief economist, said inflation remained persistent despite improving headline numbers.

“Inflation still is sticky and very persistent in the UK,” she said, noting that construction and repair costs remain particularly elevated.

Mueller (pictured) said UK and eurozone growth forecasts look similar, but masking different reasons.

The eurozone has faced external trade headwinds, she emphasised, while the UK’s weakness is “more due to domestic factors”, including weak consumption.

Fiscal consolidation will weigh further on UK momentum, she predicted.

With public finances constrained, Mueller said private institutional investors, including insurers, should play their part to help close a significant gap in capital investment.

“The contribution of capital to GDP growth has been declining, but the UK has been particularly vulnerable on that front,” she said.

Jason Richards, CEO of Swiss Re UK & Ireland, said insurers were operating at the intersection of economic, geopolitical and climate change.

Richards (pictured) stressed the sector’s resilience, despite another year of high natural catastrophe losses.

Elevated cat losses are the “theme of this era”, he observed, adding that secondary or frequency perils (taken together), such as floods and wildfires, had become the primary source of losses for reinsurers in recent years.

“We estimate that the insured losses from natural catastrophes will again be above $100bn,” he said.

“The secondary perils have become the primary perils,” Richards said, noting that 93% of European insured losses in 2024 came from secondary hazards, predominantly floods.

Richards praised the UK government’s renewed commitment to flood defences and the success of public-private partnerships such as the UK Government-backed reinsurance fund Flood Re.

Resilience should extend to infrastructure, housing and energy, he suggested, particularly for residential property, as the UK plans to build 1.5 million new homes.

“These homes must be designed to be future resilient,” he said.

He added that insurers have committed £100bn to productive UK assets, supporting transport, housing and healthcare, but warned that adaptation must accelerate globally.

“Every pound spent on prevention saves many times that in recovery,” he said.

Richards included a call for collaboration across industry, government and clients to strengthen resilience.

“Resilience is not a luxury, it’s an investment in the future,” he added.

No comments yet