Upstream profitability, surplus capacity and strong loss ratios leave buyers well placed at renewals, according to a report from the specialty broker

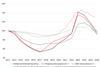

Rate softening in the global energy insurance market shows no sign of slowing as the sector heads into 2026, according to Willis’ latest Energy Market Review Update.

The re/insurance broker said insurance buyers remain in a strong position to optimise both cost and coverage, benefiting from another year of low loss activity and an oversupply of capacity.

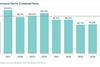

Upstream energy insurers have delivered strong profitability, with improved risk management and higher asset quality supporting favourable loss experience, the intermediary observed.

Softening has accelerated since Willis’ previous market review in April, the broker said, with insurers prioritising retention of well-managed risks and rewarding long-term relationships.

Downstream insurers, however, have reported around $3.5bn in losses so far this cycle, according to Willis, with claims roughly matching premium.

Most major losses occurred in the US refining sector, placing additional scrutiny on clients with US exposure.

Willis said businesses with clean loss histories still secure competitive terms, while companies with recent losses should expect greater conservatism, although rate reductions remain possible.

Standard cuts of 10–15%, and up to 20–50% in the most competitive tenders, have been observed, the broker added.

Trends to watch

The report highlights several dynamics shaping next year’s renewals for energy business.

Upstream construction: underwriters are becoming more accommodating on long-tail risks where strong operational relationships already exist.

Operational placements are being used to support construction programmes, representing an increasingly important tactic.

Subsea construction: capacity remains limited, creating a micro hard market.

Some insurers are considering writing small lines to secure premium income despite broader soft market conditions.

Upstream treaty reinsurance renewals: insurers’ willingness to buy high-level top-up layers on capacity-heavy assets will signal whether they intend to maintain or grow market share, or recalibrate budgets in 2026.

Liability trends: strong capacity and positive international loss ratios are driving a softening environment outside the US, in contrast with the US casualty market where social inflation and nuclear verdicts continue to pressure limits.

European insurers are meanwhile concerned about new class-action legislation that may raise liability claims costs.

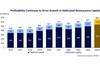

Rupert Mackenzie, global head of natural resources at Willis, said clients were set to benefit as the market heads towards year-end.

“Insurers have reported strong financial results at the end of Q3,” he said.

“The ongoing oversupply in capacity and insurer appetite for growth is simplifying previously complex verticalised placement structures, yielding premium savings for clients.

“This means that energy companies renewing in Q4 2025 and looking forward into 2026 are in a strong position, with room to negotiate conditions in addition to price,” Mackenzie added.

No comments yet