New analysis points to rising protest size, more frequent disruption and growing damage to commercial property, with Europe and the US emerging at the highest risk of becoming SRCC flashpoints

Insurers should prepare for more frequent disruptive protests and riots in 2026, according to new research from Verisk Maplecroft, which says civil unrest is increasing in size, frequency and impact across major economies.

The geopolitical risk analytics firm’s latest civil unrest index shows that protest activity has risen worldwide over the past two years, while commercial property is being targeted more often, causing hundreds of millions of dollars in damage and business interruption.

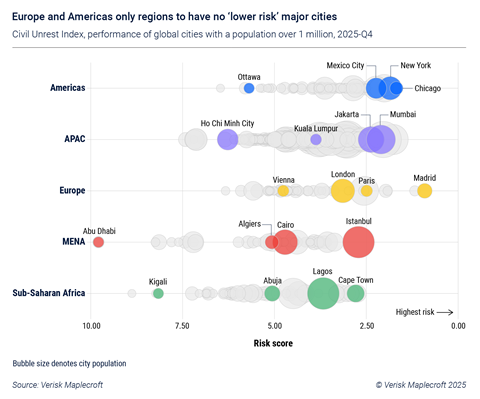

Seven of the world’s largest economies rank among the highest-risk countries, with Europe home to five of them: Germany, France, Spain, Italy and the UK.

The US, which recorded the sharpest increase in protest size over the last 12 months and ranks third globally, is another major concern. Brazil, Mexico, India and Myanmar complete the top 10.

Torbjorn Soltvedt, associate director of political violence at Verisk Maplecroft, said 2026 is likely to be more disruptive for political violence (PV) insurers and their polcyholders than 2025.

“Based on the frequency and intensity of protests and the underlying factors that drive unrest, such as economic volatility, income inequality, the conduct of security forces, and corruption, we expect next year to be more disruptive than 2025,” he said.

Western pressures mount

Europe is the worst-performing region on the index, with protests increasing in size and causing more frequent damage to private property.

The infographic above shows that Europe and the Americas are the only regions without major cities deemed low risk for civil unrest, otherwise known as strikes, riots and civil commotion (SRCC) in PV nomenclature.

Europe in particular is also grappling with increased defence spending, global trade volatility and concerns over competitiveness, all of which are straining public finances.

Research from Verisk Maplecroft warns that mounting economic pressure may deepen poverty and social inequality, both key drivers of unrest.

SRCC tensions are most visible in France, where opposition to proposed public spending cuts triggered large-scale demonstrations. An estimated 195,000 people took to the streets at the start of October.

Political polarisation is also fuelling discontent over migration, the report’s authors emphasised.

Protests exceeding 100,000 people have been recorded in the UK and Germany, centred on calls for tighter immigration controls. While those demonstrations were mostly peaceful, others in Spain and the Netherlands have turned violent.

The combination of economic pressure, migration-related anger and political division is creating “a volatile mix for Europe”, particularly in its largest economies, where the outlook for unrest is bleak.

Across the Atlantic, the US has seen the largest rise in monthly protest size, from an average of 172,000 people at the end of 2024 to 696,000 a year later.

Polling shows political polarisation has accelerated over the last decade. Combined with rising protest activity, Soltvedt said deepening divides increase the risk of more damaging unrest.

Data also shows protest activity in 2025 was more intense than in the 12 months leading up to the 2020 BLM protests, which generated around $3bn in insured losses.

Violence and property damage rare but rising

Verisk Maplecroft’s research stressed that some 90% of protests remain peaceful.

Only 10% turn violent, including clashes between protestors and security forces or between opposing groups. Fewer than 1% directly damage property through vandalism or looting.

However, attacks on commercial property, whether born by property or PV insurers from market to market, are becoming more common.

Fifty-three countries recorded rising attacks over the last year, with Kenya, Mozambique, India, Mexico, Peru, DR Congo, Indonesia, Germany, Bolivia and Spain seeing the steepest increases.

Indonesia and Nepal illustrate how quickly unrest can escalate, the report observed.

Widespread rioting in Indonesia in August is expected to top $50m in insured losses, while losses from this year’s protests in Nepal are likely to match the 2015 earthquake, which exceeded $200m.

Across 2025, corruption has been a consistent trigger of unrest in countries swept up in the recent wave of ‘Gen Z’-driven protests, the research notes.

“With political polarisation rising, and the increasing ability of social media to intensify protests, the likelihood of major episodes of unrest across the world is rising,” Soltvedt said.

“Understanding the underlying risk of protests in individual countries and cities will be crucial to help business and insurers distinguish between temporary flashpoints and more structural long-term civil unrest risks,” he added.

No comments yet