No longer peripheral, political violence, SRCC and wider geopolitical risk have shifted firmly into the core of underwriting and capital decision making, according to the reinsurance broker’s assessment of the 1 January 2026 renewals.

Political violence and strikes, riots and civil commotion (SRCC) risks have become a structural feature of the global risk environment rather than a passing phase, as reinsurers move beyond the 1 January 2026 renewal season, according to new analysis from reinsurance broker Howden Re.

Heightened geopolitical volatility has continued into the new year, the broker said, following a decade in which loss expectations have remained persistently elevated and political risk has increasingly shaped portfolio construction.

Strategic competition between major powers has intensified, while intrastate conflict and localised violence involving non-state actors have continued to rise.

At the same time, the reconfiguration of the global economic and geopolitical system has become more pronounced, with implications for security, capital allocation and political stability.

Global insured catastrophe losses have exceeded $100bn in every year of the current decade, reinforcing challenges around insurability at a time of higher inflation, lower trend growth and more frictional trade conditions.

Richard Miller, managing director, specialty reinsurance at Howden Re, said political violence and SRCC had moved decisively into the market’s core.

“Political violence and SRCC risks are no longer peripheral considerations for the market,” Miller said.

“After several years of sustained geopolitical volatility and structural change, reinforced by elevated loss expectations across the current decade, these risks have moved decisively into the core of underwriting and capital decision-making,” Miller added.

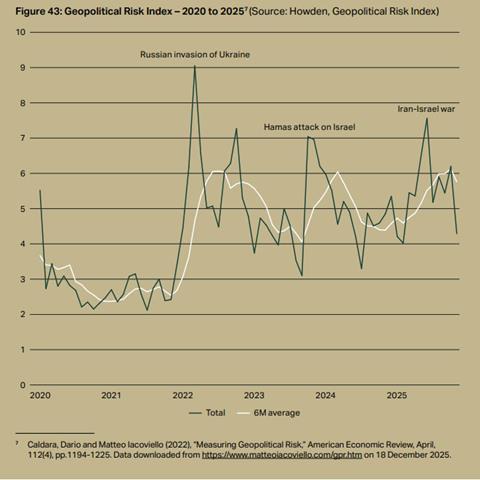

Risk indicators have risen sharply through the 2020s, driven largely by wars in Ukraine and the Middle East, according to the broker’s analysis (see chart).

The brief but intense confrontation between Iran and Israel in June 2025 highlighted how quickly conditions can deteriorate, feeding directly into 1 January renewal discussions.

Post-renewal developments in Venezuela, alongside mounting concerns around the US, Denmark, Greenland and the Nato alliance, have underlined the potential for near-term supply chain shocks and pressure on longstanding security alliances.

Hybrid warfare activity has also increased, with cyber attacks, drone incursions and sabotage targeting critical infrastructure, defence assets and aviation, while obscuring attribution, Howden Re observed.

David Flandro, head of industry analysis and strategic advisory at Howden Re, suggested this was blurring traditional risk boundaries.

“We are seeing a broadening of geopolitical risk,” Flandro said.

“This blurs the traditional boundaries between political violence, war and economic disruption, with important implications for how risk is understood, modelled and ultimately transferred.”

More than two-thirds of multinationals now use political risk management tools, with uptake expected to rise further as uncertainty persists.

Miller said the 1 January renewal showed political violence and SRCC risks remained insurable, with capacity and expertise available.

“Absent a significant market-changing event, we expect political violence and SRCC markets to remain competitive and well supplied in 2026,” he added.

No comments yet