All News articles – Page 28

-

News

NewsOasis publishes exposure management C-suite guidance

“Navigating the Storm - The C-Suite Guide to Mastering Exposure Management”, from the the open source cat modelling platform, aims to provide best practices for resilience, compliance, and profitability in an unpredictable global environment.

-

News

NewsHannover Re CEO Henchoz to step down in 2025; CFO Jungsthöfel to take top job

Clemens Jungsthöfel will take over the group chief executive role at Hannover Re from 1 April 2025.

-

News

News‘Rosy picture’ belies the challenges carriers face, Convex’s Brand warns

Speaking at an AM Best event in London, Convex’s CEO gave a (re)insurance carrier’s perspective to challenges, from claims activity, operating expenses and market cyclicality, to the balance of power between brokers and carriers.

-

News

NewsSwiss Re strengthens US liability reserves by $2.4bn

The reinsurer made its “ad hoc announcement”, saying it would miss its combined ratio target for the year as a result, with third quarter net income of $0.1bn.

-

News

NewsPool Re appoints Stark as head of underwriting

Andrew Stark starts a newly created role at the UK’s terrorism reinsurance public-private partnership.

-

News

News‘Polycrisis’ presents insurers with ‘impactful’ opportunity – Axa UK & Ireland CEO

Plus, Aviva’s UKGI boss emphasises that insurers must ‘put our money where our mouths are’ when it comes to engaging on ‘collective goals’.

-

News

NewsTwo-thirds of insurers plan to implement AI predictive models within two years – Earnix

The technology firm surveyed more than 400 global insurance executives to uncover technology and artificial intelligence (AI) trends, revealing that replacing legacy systems remains a significant challenge.

-

News

News‘Inflection point’ reached in US casualty reserving – Lockton Re

Reinsurance broker’s paper highlights potential end to material adverse development in casualty lines for calendar year 2025.

-

News

NewsAon Underwriting Managers hires new CUO

Simon Clapham, formerly of Brit and Liberty Specialty Markets, joins Aon’s MGA operation as its chief underwriter.

-

News

NewsExtinction Rebellion targets multiple London market insurance firms

The climate change protest group has carried out a campaign of protests targeting insurance companies across London.

-

News

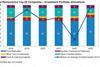

NewsReinsurer ROEs rise on underwriting, investment results – AM Best

AM Best’s DuPont analysis indicated reserve leverage for the composite dropped, led by non-life reinsurers, other than the ‘big four’, whose reserve leverage was relatively stable.

-

News

NewsRiverStone and QBE announce loss portfolio transfer deal

Run-off re/insurer takes on reserves of $1.2bn for Lloyd’s syndicate legacy business from QBE.

-

News

NewsSaudi Vision 2030 & GHE 2024: where the tech revolution and health re/insurance meet

Editor of GR, David Benyon, reflects on health technology trends for re/insuring the sector, from a recent trip to Saudi Arabia, attending GHE 2024.

-

News

NewsNat cats in 2024 likely to surpass last year’s claims bill – Aon

A Q3 Global Catastrophe Recap report from Aon Reinsurance Solutions sees nat cat losses already exceeding $102bn for this year, while global reinsurer capital neared $700bn as of the year’s halfway point.

-

News

News‘Do the simple stuff first’ with data journeys – AdvantageGo’s Summers

Long projects in technology have very bad track records,’ warns AdvantageGo’s global business leader Ian Summers.

-

News

NewsFrom Mariupol to Gaza – measuring political violence losses with Charles Taylor Adjusting

Loss adjustment from warzones is a service in high demand, given the geopolitical state of the world in 2024, and the rising prominence of war, political violence and terrorism business among London market re/insurers.

-

News

NewsAI and insurance: ‘The Hare and the Tortoise’ – Earnix CEO interview

The insurance industry is renowned for its conservatism; AI on the other hand, is talked of in revolutionary terms; where and how will the two meet?

-

News

NewsBetter risk selection could cut 16% from cyber insurers’ loss ratios – Gallagher Re

After a global study of 62,000 organisations, the reinsurance broker suggests removing “most at risk entities” from cyber insurance books could reduce loss ratios by up to 16%.

-

News

NewsIndustry relevance focus at Baden-Baden for Guy Carpenter, Swiss Re

Reinsurance broker Guy Carpenter emphasised “clearly defined roles”, partnership and innovation for its Baden-Baden Reinsurance Symposium.

-

News

NewsIUMI’s marine insurance stats reveal premiums rise

A 2024 analysis of the global marine insurance market was released by the International Union of Marine Insurance.